Hi, My cost basis (i.e. purchase value) in PP does not match my cost basis in Interactive Broker for my Glencore shares. The reason for this is that I have received a “Return of Capital” (ROC), which adjusts my cost basis (i.e. purchase value) lower. What is the best way to account for this change in cost basis? Is there a transaction type in PP that can account for this or do I need a workaround?

As far as I understand the ROC is tax topic, right?

From a performance perspective this must not be reflected as tax doesn’t influence performance but capital gain/loss.

If you ignore this fact you can edit your purchases prices, but this will lead to a performance increase which never happened in reality.

So in case I understand your question correctly, it’s up to you how to handle it. A dedicated transaction type does not exist.

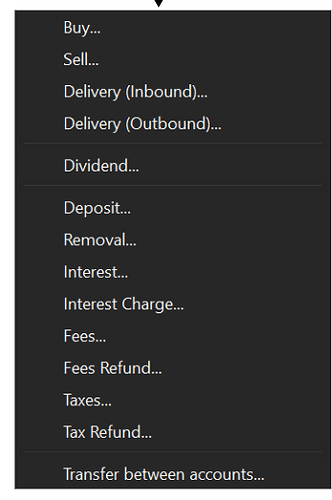

All possible transaction are:

and can be found here: Menu - Portfolio Performance Manual

Hi, ROC is a payment per share that will adjust the cost basis of your shares which means when you sell your shares the capital gains tax on the share is different. This differs from a dividend which is taxed according to income tax (not CGT) and does NOT adjust the cost basis of your shares. Those options you list do not include ROC, so I am wondering if someone has a work around to change the cost basis of the shares (apart from simply editing the value of the shares manually).

So my understanding is right so is my answer.

Lowering your cost base will increase your performance which is simply fake.

Performance gets measured from the original purchase price to selling price… not more not less.

The point is that in order accurately reflect my performance after tax, I need to know which performance is from capital appreciation (ROC will adjust my cost basis and therefore impact capital appreciation) and which performance is due to dividends (ROC does not impact dividends and therefore is income tax irrelevant). Therefore it is necessary to be able to adjust cost basis of my shares in the event of ROC.

In addition, in order to be able to compare cost basis with my broker (IB in this case) I need to be able to replicate the same process that they employ. Only this way will PP accurately reflect my broker account (which is one of the aims of the software). Therefore, to accurately reflect IB, PP needs to be able to take into account FIFO, ROC and fees in the cost basis calculation. So my question is: Is there a way to adjust the cost basis to include ROC and fees?

I understand what you try to achieve. But PP can’t handle it different to what I initially wrote you.

PP is a performance tracking tool and doesn’t care about taxes rather after you entered them.

Then adjust the purchase price. And deal with the consequences.

The aim is to have a precised tool to measure performance not to replicate what brokers are publishing.

Ok – Then the only workaround is to adjust the price. Understood.

I think this is the difference between Book Value and Adjusted Cost Base which takes RoC into account? Maybe

I’ve created a ticket for Return of Capital tracking: Return of Capital events or transactions required to keep Book Value in sync with brokers · Issue #4681 · portfolio-performance/portfolio · GitHub

Doesn’t your book value, basis cost adjust at the date of the return of capital?

If so, would it work to enter a sell txn at the price on that day and a buy txn at the revised cost (i.e. same number of shares at a cost of the value of the sell txn minus the capital returned)?

I’ve not tried it so not sure if the performance calculations then make sense or not.

I did have one of these, but in that case the company issued a B share class and immediately bought it back to provide the return of capital. They then consolidated the original share class. Fun and games trying to track that and report it correctly for tax.

On my broker statement yes it does, but PP doesn’t have an RoC transaction.

I guess there two things going on here:

- To double-check I’ve entered (or imported) information correctly from my broker I want as many numbers as possible to be identical. Currently I rely on cash balance and number of shares but having BV the same too would be really helpful; and

- As a one-stop-shop for my investment decisions I would need PP to accurately reflect my portfolio (or at least an important shop, I know I need other inputs to make my decision).

I realise RoC is justing incoming cash flow, like a dividend (or interest, depending on the security) so in that perspective it doesn’t change what I originally paid to acquire the shares. But it does change how much I will gain when I sell the shares, especially for tax purposes, so it can be valuable when deciding whether to match the gain with a loss or deferring the sale to another period.

I would like to get as much information as I can from PP, especially if I can get all of the same type of information from PP.

I really appreciate that PP is going beyond the simple calculations most websites throw at you; and I like having all my data on my computer as opposed to someone else’s (i.e.: the cloud). So if I could get this info from PP as well that would just add to it’s greatness!!!

Yes, that is all it is. A positive or negative value at given date for zero shares: 9.9. Return of Capital

Edit the xml data file manually.