Hi,

I noticed that PP mobile, in the Performance tab, does not handle the tax calculation well (at the security level) when a “tax refund” is present. I use this method to correctly record bond coupons (as described in PP’s documentation).

In the Desktop version, the calculation is correct (entire portfolio performance), i.e., the amount for the “tax refund” item is excluded from the tax calculation. Thank you!

I attach two screenshots. Do I miss something?

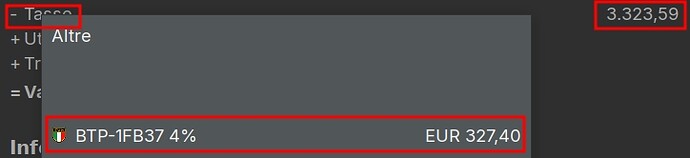

Desktop version (latest version. Linux)

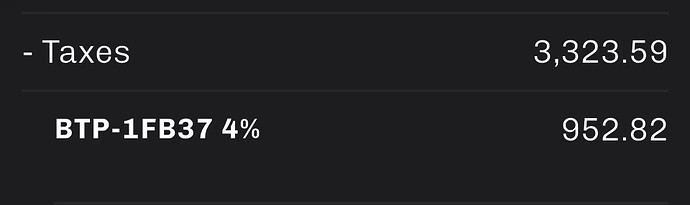

Mobile version (latest version. IOS)

Hey @fabio85, thanks for bringing this up and sending those screenshots! I see the difference between the Desktop and Mobile versions. Can you tell me which version of the iOS mobile app you’re using? It might be a good idea to check if this problem still happens after the latest update. Have you checked any specific settings in the mobile app for tax calculations, or does it seem like the mobile version just works differently from the Desktop one? If it turns out to be a bug or something missing in the mobile app, let’s report it to the devs or through the official support channel.

Hi,

The mobile app version is 1.9.0 + 126

it sema a bug. I also report this bug to the official github