Franking Credits are part of an investor’s income and not a tax they pay. Nevertheless, if the tax field is not used (as is normally the case for Australian investors) it can usefully be co-opted as the Franking Credits field.

I recommend the following workaround demonstrated using the data given in Import CSV file

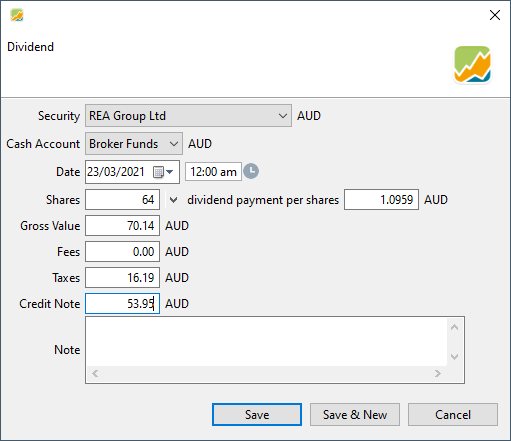

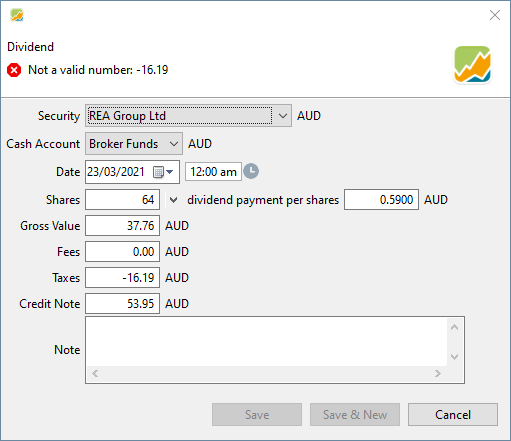

Enter the dividend with Gross Value blank, Taxes containing Franking Value, and Credit Note containing Total (Franked, Unfranked, and Franking Credit (Imputation Credit)).

Let’s demonstrate it using the GUI and a text editor:

Paid,Code,Shares,Dividend,Franking,Total

23/03/21,REA,64,37.76,16.19,53.95

It is best not to enter Gross Value, and enter Taxes before Credit Note and note as the last digit is entered for Credit Note that Gross Value will update.

Save the file and exit Portfolio Performance.

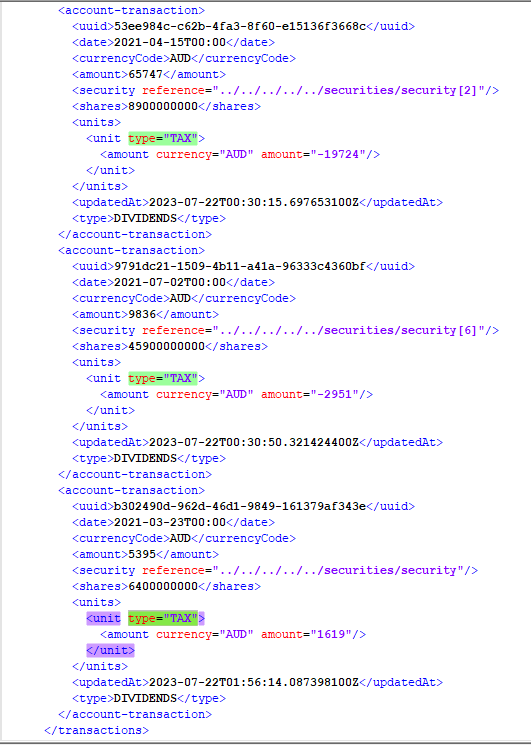

Now open the *.xml file in a text editor (eg NP++) and search for type="TAX". Make the Tax value(s) negative and save the file. You can see below amount="1619" needs to be changed to amount="-1619".

If you open Portfolio Performance again and view the transaction the Gross Value has been updated but if changes are made the taxes must be saved as a positive value (and edited in the text editor again).

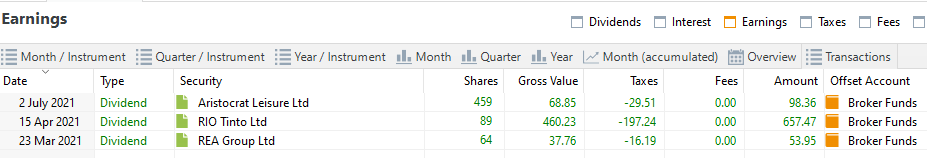

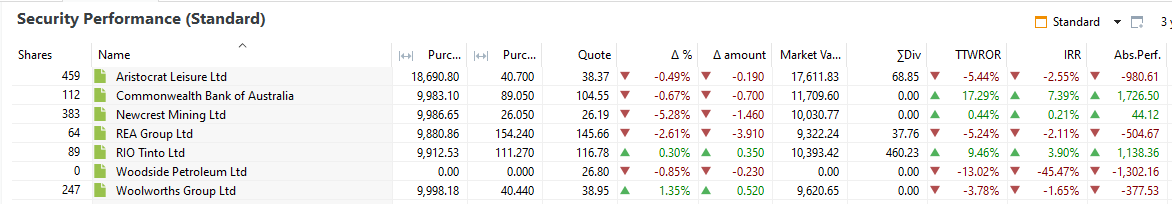

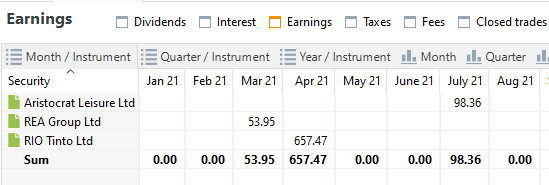

Portfolio Performance will now have the full dividend income which will be used in calculations:

Taxes can change over time but with a constant (30%) Franking Credit, the Franked and Unfranked amount can be calculated from the Total amount.

Be aware of the concerns raised in this topic but don’t be concerned.

Portfolio Performance

Version: 0.64.4 (July 2023)

Platform: win32, x86_64

Java: 17.0.5+8-LTS, Azul Systems, Inc.