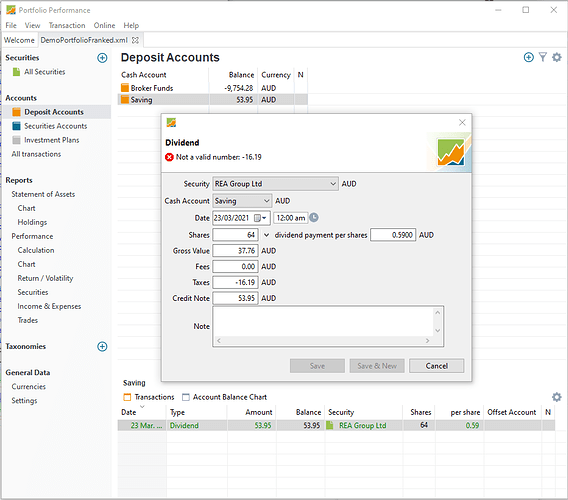

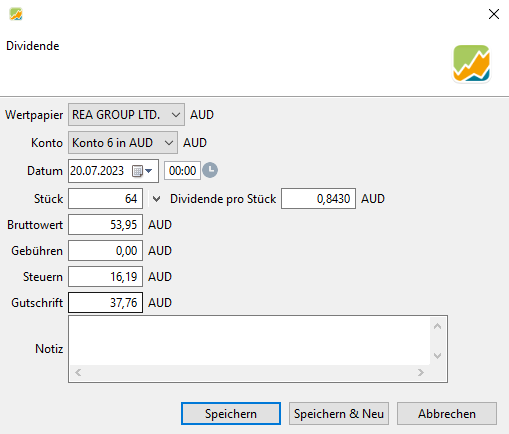

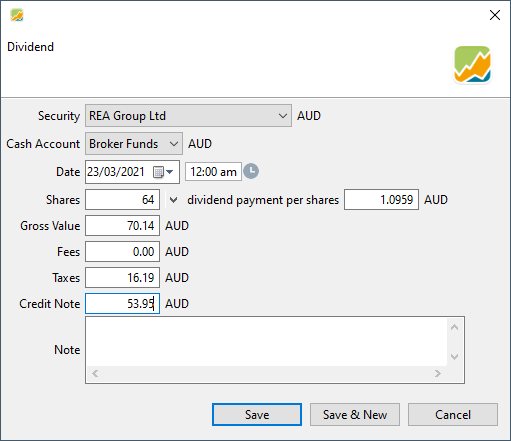

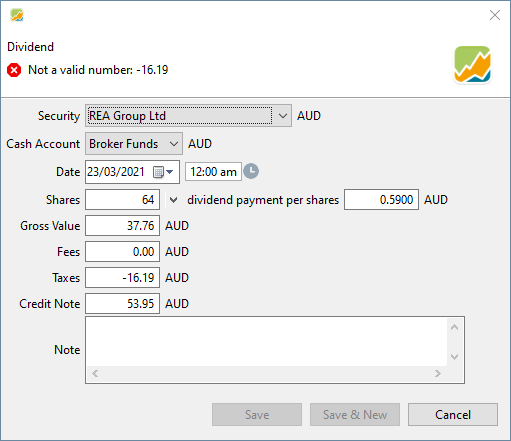

How can dividends with imputation credits be entered? The dividend is paid into a bank account but it also includes a tax credit. The Dividend form does not allow negative tax amounts.

eg

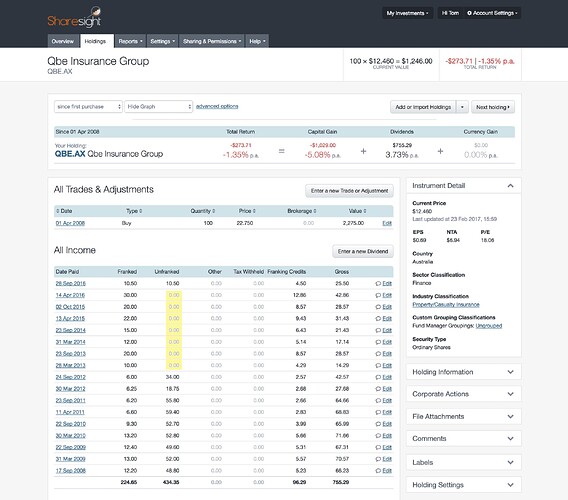

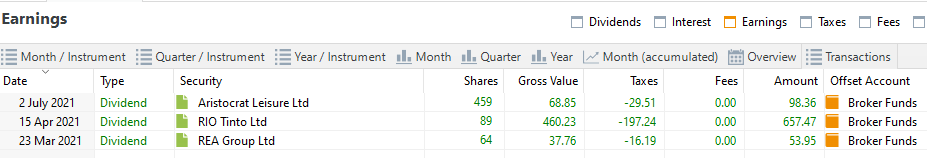

Paid Code Shares Dividend Imputation Total

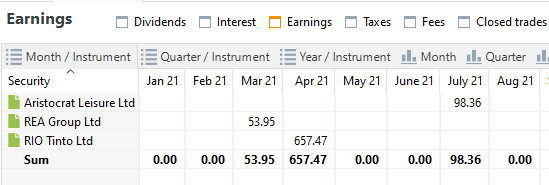

23/03/21 REA 64 $37.76 $16.19 $53.95

Dividend imputation is a corporate tax system in which some or all of the tax paid by a company may be attributed, or imputed, to the shareholders by way of a tax credit to reduce the income tax payable on a distribution. In comparison to the classical system, it reduces or eliminates the tax disadvantages of distributing dividends to shareholders by only requiring them to pay the difference between the corporate rate and their marginal tax rate. The imputation system effectively taxes distributed company profit at the shareholders’ average tax rates.

Australia, Malta[1] and New Zealand have imputation systems. Canada, Korea and the United Kingdom have a partial imputation system.[2] Germany had a dividend imputation system until 2000 and France until 2004.

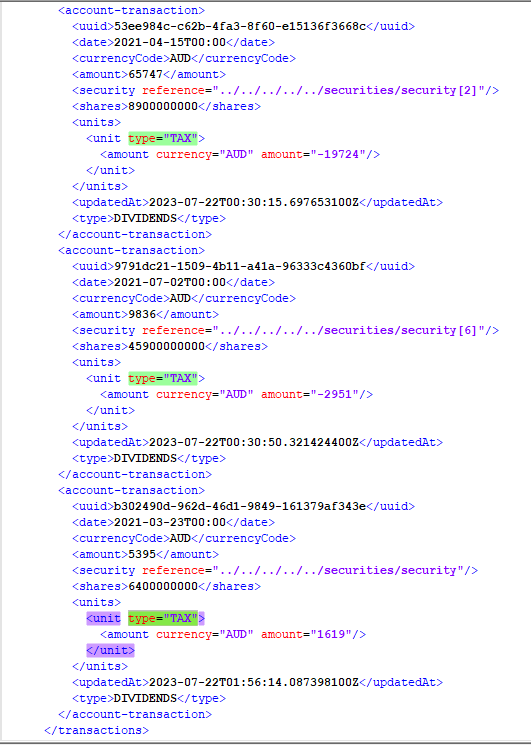

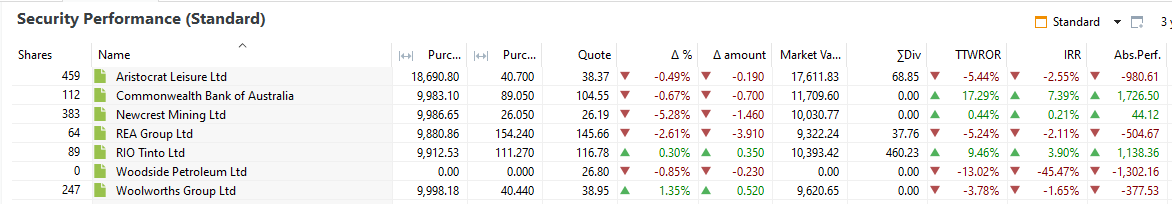

I edited the xml directly to create this screen. Amount paid into bank account is $37.76 and real value for analysis is $53.95: