Hello,

I know there are many similar posts. I have read quite a few and also checked various other sites for explanation, but I believe the example I will show you is really odd. I would kindly like to ask for help with interpreting the calculation of TTWROR of an investment in the Portfolio performance software.

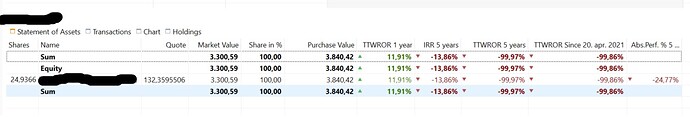

The calculation of the TTWROR for an investment in the last 5 years shows -99,97%, which would imply that I have lost almost all of my money, but this is definitely not the case. Portfolio performance calculates only -24,77 % absolute performance, which is about right. See the appended picture of calculation from Performance portfolio. The security in question has risen about 22% percent in the last 4 years. I don’t have quotes for 5 years.

I have also exported the transactions in this Securities account to .csv and they’re appended if someone can make use of them to understand how PP calculated this TWTWROR. The quotes that PP uses for the calculation were provided from the buy and sell transactions.

Transactions_PP-za forum.csv (11.6 KB)

I will of course provide any other necessary information.

Thank you very much for your help!