Hi Andre,

great to hear. Oh yes of course. It is a bit tricky but let me try to explain it for you.

First of all it depends on which type of asset you want to add.

For ETFs please do the following:

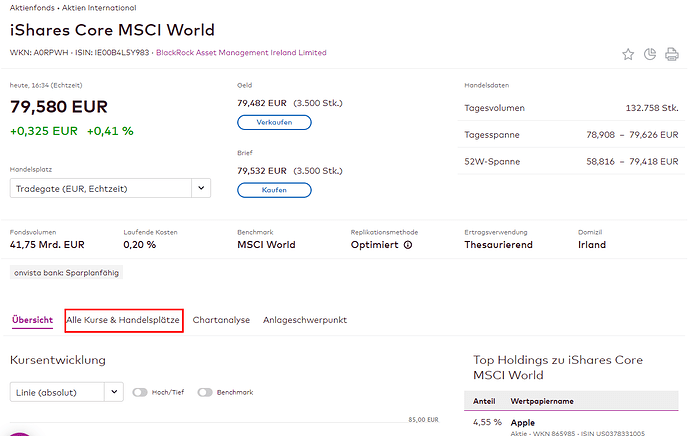

- Go to https://www.onvista.de/ and search for your ETF by using the search bar in the upper right corner

- If you found your ETF then go to the Tab

Alle Kurse und Handelsplätze. Maybe you have to scroll down a bit

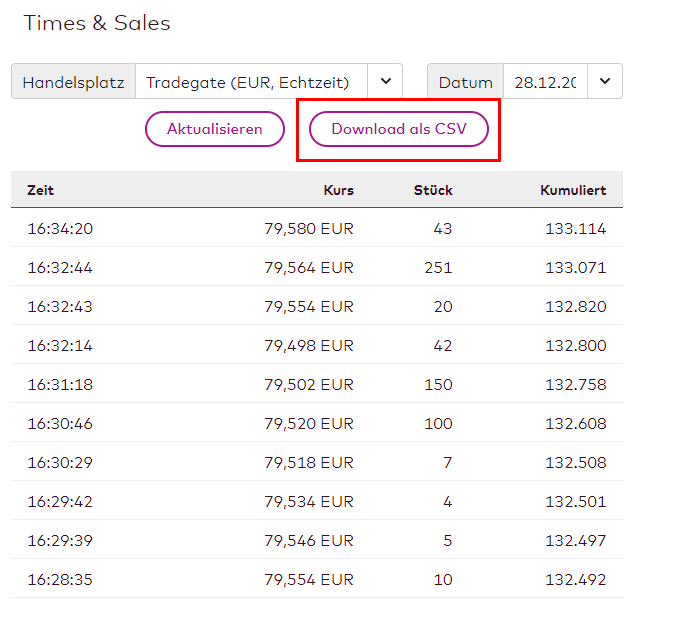

- After the view of

Alle Kurse und Handelsplätzeopened, please scroll down to the sectionTimes and Sales - Choose your desired

Handelsplatz(aka Stock Exchange) and klick on theDownload als CSVbutton.

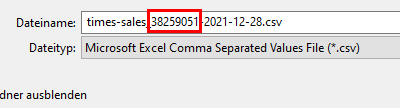

- A new Windows window will open where you can save the

.csv, but this is not required. You need only from the file name thenotationId. See below screenshot to find the right number.

If we talking about Aktien/Stocks then the approach is a bit different to find the notationId because Onvista has different screens for stocks.

For stocks do the following:

- Go to https://www.onvista.de/ and search for your Stock by using the search bar in the upper right corner

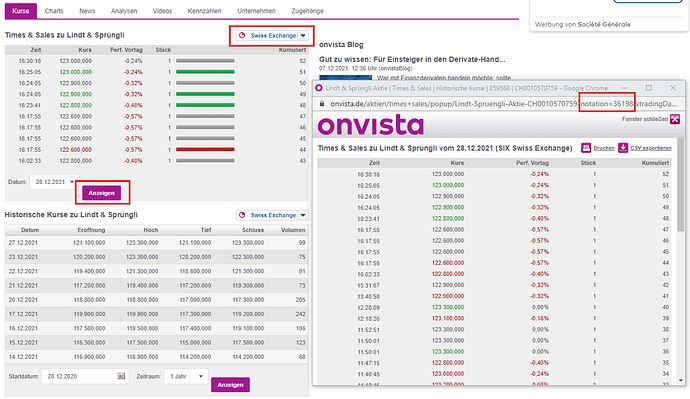

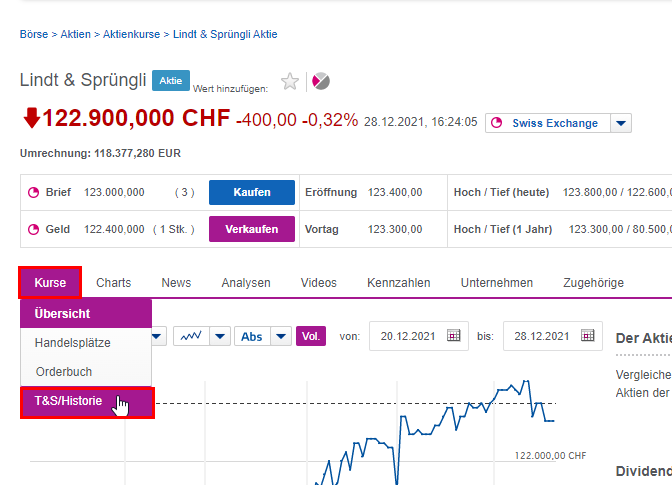

- If you found your Stock then swipe over the Tab

Kurseand select from there the viewT&S/Historie.

- On the new view that opened you will find two sections

Times & SalesandHistorische Kurse. Here it doesn’t matter from which one you will take thenotationId. For instance if you choose theTimes & Salesyou can again choose your desired exchange and after that click on the buttonAnzeigen. - A new window will open where you can see in the search/navigation bar the full link/url and inside the url you see the

notation. The number from there is yournotationIdthat you can use.

Please note:

- Choose always first your desired exchange. Because if you need a different exchange then of course the

notationIdwill be a different one. - The generic link that I posted

https://www.onvista.de/onvista/times+sales/popup/historische-kurse/?dateStart={TODAY:dd.MM.yyyy:-P5Y}&interval=Y5&assetName=a&exchange=a¬ationId={TICKER}

is looking only 5 years back. So in case you need more historic data you have to adjust the interval accordingly. - As I said this approach was already described in this forum. I found the link Quellen für historische Kurse where I got the initial idea as well. So all props goes to the initial source of the how-to :-).

Best

Alex