A return of capital reduces the capital purchase cost of the shares, yet I cannot find a Transaction sub heading to record such an event (it has happened to me recently with 2 shares held in my portfolio).

A payment from a share is simply a dividend.

There may be a difference for the taxman (of your jurisdiction), but PP doesn’t care about tax rules.

@chirlu given it’s a return of capital, this affects performance figures too, no? It can’t simply be recorded as a normal dividend.

A regular dividend is also a return of capital.

No, it’s a fundamental decision, income is not capital.

@chirlu Picking this up again, now I’m in a position to reconcile performance figures between PP and my broker.

I cannot see how a return of capital can be safely treated as income - it distorts the performance figures.

Return of capital doesn’t represent any earnings on top of what was originally invested - the capital base of the investment is reduced, which means there is less money at work potentially generating returns going forward.

To give some concrete examples here:

Example 1: Treating Return of Capital as Income

Let’s say you have an investment of £10,000 in an income fund that gives you a return of capital of £200 and an actual income (notional dividend) of £300 over a certain period.

If you erroneously treat the return of capital (£200) the same as income (£300), your perceived income would be £500. If the fund’s value increased to £10,500 (a £500 gain from the increase in the NAV), your total perceived gain would be £1,000 (£500 from perceived income + £500 from the increase in NAV), representing a 10% return on the £10,000 initial investment.

However, this is not accurate, because part of what you’re counting as gain is simply your own money returned to you.

Correct Treatment

The correct calculation would recognise only the actual income of £300 as a gain. The return of £200 is merely the principal being paid back. Therefore, the real gain is the actual income (£300) plus the increase in NAV (£500), totalling £800. This represents an 8% return on the initial £10,000 investment.

The distortion becomes clearer when you consider that if you continued to mistake return of capital for income, you could theoretically ‘earn’ income even as the value of your fund was going down, which is not a reflection of positive performance.

Similarly, the reverse concept of a capital call is required IMHO. For instance, say you have a notional distribution of £100, of which £30 is an equalisation and £70 is an accumulation distribution, you will need the following:

- A dividend of £70.

- A ‘Return of capital’ of £30

- A ‘Capital call’ of £100 (as there is in fact no cash distribution)

You are doing mental accounting. It’s all your own money.

If you say so - but unfortunately it makes the performance calculations unusable as I cannot meaningfully compare to any other benchmark.

To give you a concrete example.

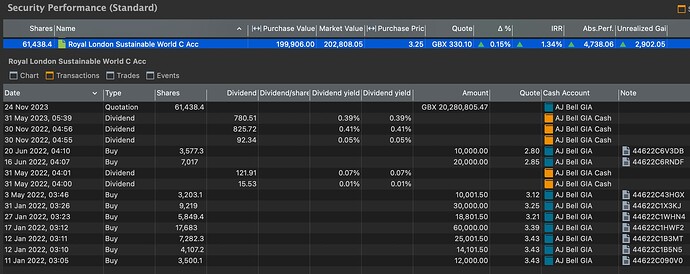

According to PP:

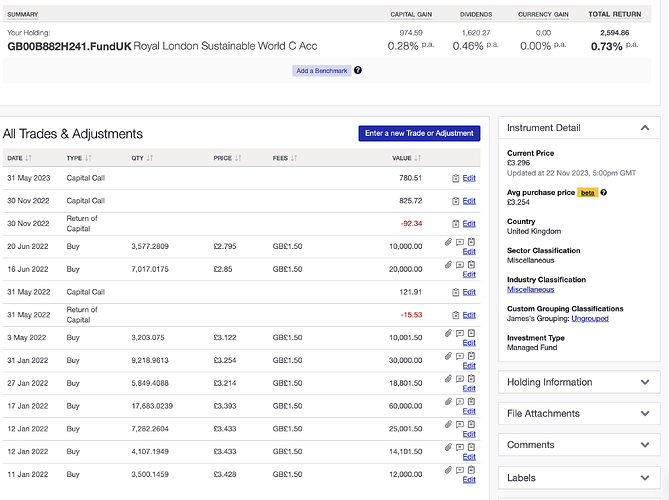

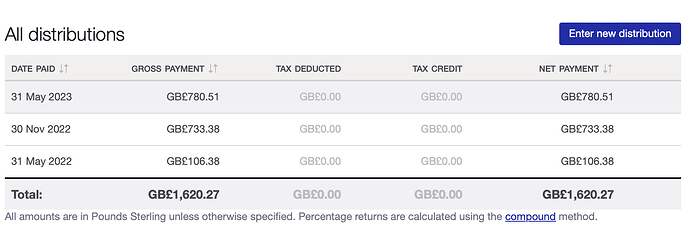

vs ShareSight, with the Capital Call/Distributions:

Please do correct me if I’m mis-understanding and there is a way to get these aligned? I’ve tried adjusting the dividends to match the net of the accumulation and the equalisation, but performance is still not correct.

I’m not clear if I should immediately do a ‘Buy’ again of the notional distribution in PP - but you aren’t gaining any more shares, and it’s not possible to record a 0 buy.

Unfortunately, I don’t understand it. Why does a supposedly accumulating share class even pay dividends?

I had to deal with this problem in PP and have to agree with Abacus6923 and firewire. A Return of Capital is not a Dividend. Not from the shareholder’s perspective nor that of the company issuing the return.

A Dividend is a share of a company’s profits. It is income to the shareholder and may be subject to income tax.

A Return of Capital is a lowering of a company’s indebtedness to its shareholders. It can be considered as a return of money you originally invested. It lowers the Cost Base of the investment and is not assessable as income.

But it would be considered a Capital Gain if the Cost Base drops below zero and may then be subject to capital gains tax.

And, because an investment’s performance is measured against its Cost Base, this will be affected by a return.

My work-around in PP was to create an “Event” for the date of the return with a brief description, eg. RoC $2.50 per share.

Then edit the original Buy transaction(s) manually, subtracting the amount of the payment. I include a note pointing to the Event as Events aren’t shown in the transaction histories but Notes are.

In a simple case this is enough to bring PP in line with the real world. Account balances agree with reality. Past estimates of performance become obsolete and future estimates are based on the revised Purchase Value.

If you use two money accounts - one for purchases/sales and another for payments - then you’ll need to do an additional transfer to bring everything back into agreement – moving the payment to the purchases/sales account.

This solution is not ideal as it alters the transaction history rather than making a new entry but I see no alternative. I have other documents that record the actual events in correct order.

PP does not even seem to recognise the concept of a Cost Base which is separate from the original Purchase Value.

The original purchase is a fixed historical event. The Cost Base is the sum of all capital related events and can vary over time. It would appear in a separate column.

From the shareholder’s perspective, it is very much a dividend. The internal perspective of the company does not play a role in PP. From the shareholder’s perspective, only tax issues are affected.

Best Regards

Sorry @chirlu, you are indeed correct here. I was thrown off by some other numbers, but if we are happy with the cost base being incorrect, the capital gain/performance will still be correct if we disregard all notional dividends and equalisations.

Yeah, if Book Value in PP doesn’t match my broker statements it makes hard to double-check that I entered everything correctly!

Did you ever find a better way to do it?

I’ve created a ticket to track Return of Capital: Return of Capital events or transactions required to keep Book Value in sync with brokers · Issue #4681 · portfolio-performance/portfolio · GitHub

No I never did, I’m sorry.

But I note that PP does recognise stock splits and it handles them in the same way as my work around for return of capital. That is: by altering the original cost base.

Not ideal but it may not be too significant. You just need to be aware of the problem. I certainly wouldn’t rely on PP come tax time.

And I’ve always used more than one set of records to help catch data entry errors – which, I admit, I do make occasionally. If you reconcile two sets of data regularly it’s not too tedious a job to find a mistake.