Hello @Veterini,

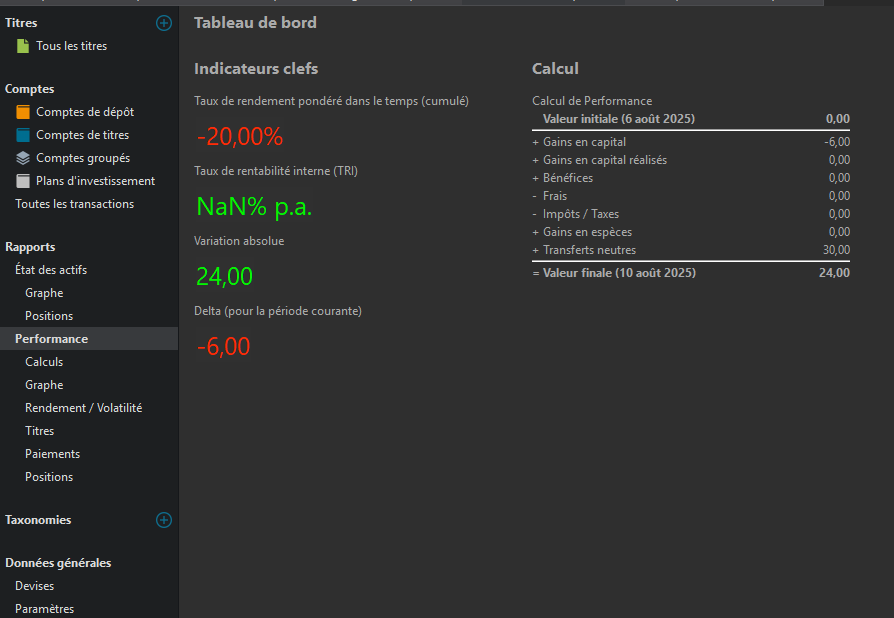

I’m sorry to say this, but I find this indicator appalling. If we add the TTWROR p.a., the combination is far from convincing. Let me explain.

On the TTWROR (I’m using the data from your xml file)

As can be seen in the three tables side by side, the TTWROR is +20% (left and right tables), which is correct given the price increase from €10 to €12, if, and only if, purchases are made before 1 February (at €10 in this case) or after. A purchase on 1 February gives a variable result depending on the change in price between the previous day and 1 February. With a change of 10/20/12, the cumulative performance is 33.33% instead of 100% for purchases before or after 1 February. But the anomaly is not limited to the doubling of the price between 31 January and 1 February. If the price increases by 10% (or any other number to be tested), the cumulative performance is 4.76% and the final TTWROR is 14.29%. This is not 20%, which should be the case since the price rose from £10 to £12.

In a real-life situation, our simple example does not apply, and it is very often the case that we buy at a higher price than the previous day, or at least a different price (I have not tested a falling price, but I imagine the results would be similar). As soon as the price rises compared to the previous day and we buy, the TTWROR does not reflect the reality of the price change (+100%, +10%, etc.). This is simply because the incoming transfer in our example is taken into account when calculating the TTWROR. Still in our simple example, the TTWROR is accurate (+20%) if and only if the price has not changed from the previous day, which almost never happens.

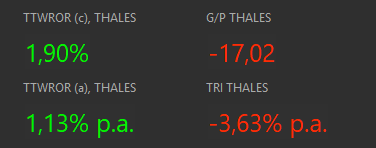

In a previous message, you told me: “TWR doesn’t care that you invested more money during the -40% period than during the +100% period. It cares that you invested in a stock that went from €10 to €12 (+20%) overall. Good choice of stock.” This is not what we observe in reality. The TTWROR is in fact +20%, but an anomaly creeps in on the day of purchase when a change in price has occurred. And quite seriously, unless I am completely misunderstanding and am hopelessly confused, a TTWROR that displays an inconsistent result, totally dependent on the rise or fall in the price compared to the previous day, does not seem to me to be either reliable or serious. Ultimately, how can we interpret the TTWROR for the entire portfolio, knowing that it combines all the TTWRORs of the securities in the portfolio with the anomalies we have just seen? At the moment, the TTWROR for my portfolio is 71.03%. What can I deduce from this? The IRR is 32.12%. This makes sense to me and I am able to recalculate it in LibreOffice based on cash flows.

On the TTWROR p.a.

Here too, I don’t really understand the result. The TTWROR p.a. is calculated based on the length of the observation period. For me, that’s 1 November 2023. So all the lines in my portfolio are calculated over this observation period, even if I have only held them for a few weeks or months. A TTWROR p.a. calculated over 22 months with lines held for much less time. I don’t understand the relevance of the result.

I hope DeepL will translate my words and their nuances correctly.

En français = Après relecture après traduction, c’est loin de bien correspondre à mon propos

Translated with DeepL.com (free version)