Hi, it might be a basic question but when I impair an investment the IRR is 0 no matter dividends received or previous partial sales of the asset.

Hey Oriol,

could it have do with the period of reporting?

Hi Harry,

No, it’s taking into account 2016 till today.

For clear understanding - what do you mean by this exactly?

I mean that in the life of an investment, if this has distributed dividends, when you write it off, the IRR (or in the performance chart), for the whole period can’t be 0.

Dividends are tracked on the account they are distributed to. If you track only the security you will not get the performance of distributions.

Hi SgtWinter, thanks for the answer but I’m tracking the account where the dividends are distributed. So still no clue…

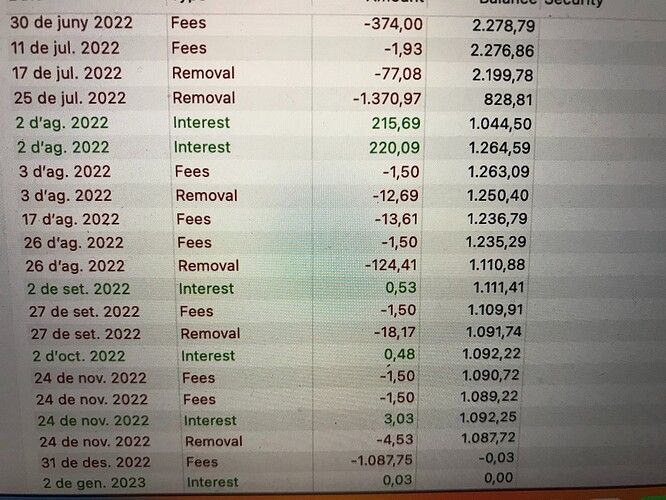

We won’t get a clue, either, unless and until you show us the transactions, the calculated IRR, and the parameters such as reporting period and data series used.

Now, where is the zero IRR being shown?

Performance = - 100%? Worse than a 0 IRR…

Certainly worse, but also correct, since everything went to fees. It’s not an IRR, though.

I’ve used fees as a way to impair. Is there a way to amortize (turn value to 0) an investment?

What does impair mean? Is it sale or revaluation?

Depreciation, but in my case 100%, so value was 0.

So you bought an asset, that looses its value over time but delivers some revenue along its lifetime?

Maybe you could have set it up as a security with declining value.

Or I bought an asset and at some moment in time I want to set its value as 0.

I believe you can create an outbound delivery (“Auslieferung”) and with a value of 0. Then you “write-off” the asset.

I have to check the IRR calculation though - in my quick check, it showed “NaN” (Not a number).

The issue here is that @Oriol insists on using a deposit account, instead of a security.

It’s how I think it fits better with crowdlending.