Hi guys,

Something has been bothering me on the Trades section because I’m having a hard time making sense of it.

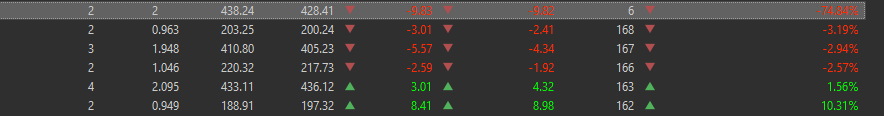

So in the Trades section I have this columns:

I believe they are the default.

Specially in two securities I don’t understand whats going on with the IRR.

First security:

On the first security I’ve bought 6 stocks, sold 5 of them first at a profit, then I sold the last share at a loss.

The IRR of the first “trade” is enormous, and it doesn’t reflect the actual profit I’ve had. IS the IRR annualized or something? and since I held those stocks for a short amount of time, that’s why the value?

What about the “NaN%”, any ideas?

Second security:

The second, I’ve bought 2 shares of a stock which I mistakenly prematurely sold, and then bought back those two shares and even bought some more on a later date.

But again some of those IRR’s make no sense in my head ![]()

I’m just trying to understand if I inputted something wrong, which might be causing other reports to be wrong.

Thanks