Hi,

I made text export from PDF statement from US broker tastytrade (former tastyworks). If it is possible to implement into PP PDF importer. There is many of junks. I think from 4 page there isn’t any importan tinks.

PDFBox Version: 1.8.17

Portfolio Performance Version: 0.63.1

-----------------------------------------

Apex Clearing Corporation

350 N. St. Paul Street 1300

Dallas, TX 75201

April 1, 2023 - April 30, 2023

PAGE 1 OF 9

ACCOUNT NUMBER 5WX-61074-19 TUA

kHZRb sBRpD

JIjRk UtBUA

A brufBi 73 51

17117 ERYBWKTo

JoQAMxnr

OPENING BALANCE CLOSING BALANCE

Cash account $2,600.05 $9.33

NET ACCOUNT BALANCE 2,600.05 9.33 Cash

0.359%

Securities 0.00 2,592.20

TOTAL PRICED PORTFOLIO 0.00 2,592.20

Total Equity Holdings $2,600.05 $2,601.53

THIS PERIOD YEAR TO DATE

Credit interest $0.02 $0.07

Equities

99.641%

See Reverse Side for Important Tax Information. This statement shall be conclusive if not objected to in

writing within ten days. Errors and omissions excepted. Please address all communications to the firm and not to individuals.

Address changes or other material changes on your account should be directed to the office servicing your account. Kindly

mention your account number. This statement should be retained for income tax purposes.

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 2 OF 9

ACCOUNT NUMBER 5WX-97563-27 TUA

APtOn PYWNY

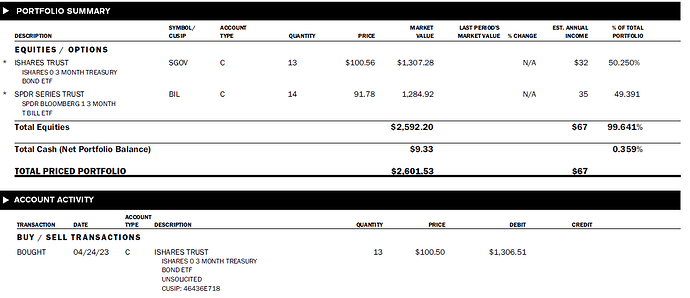

SYMBOL/ ACCOUNT MARKET LAST PERIOD’S EST. ANNUAL % OF TOTAL

DESCRIPTION CUSIP TYPE QUANTITY PRICE VALUE MARKET VALUE % CHANGE INCOME PORTFOLIO

E QUI T I E S / OPT I ON S

* ISHARES TRUST SGOV C 13 $100.56 $1,307.28 N/A $32 50.250%

ISHARES 0 3 MONTH TREASURY

BOND ETF

* SPDR SERIES TRUST BIL C 14 91.78 1,284.92 N/A 35 49.391

SPDR BLOOMBERG 1 3 MONTH

T BILL ETF

Total Equities $2,592.20 $67 99.641%

Total Cash (Net Portfolio Balance) $9.33 0.359%

TOTAL PRICED PORTFOLIO $2,601.53 $67

ACCOUNT

TRANSACTION DATE TYPE DESCRIPTION QUANTITY PRICE DEBIT CREDIT

BUY / SELL T R ANS ACT I ON S

BOUGHT 04/24/23 C ISHARES TRUST 13 $100.50 $1,306.51

ISHARES 0 3 MONTH TREASURY

BOND ETF

UNSOLICITED

CUSIP: 46436E718

* These securities have been set up for our dividend reinvestment program. Securities eligible for dividend reinvestment include most marginable equities, closed end mutual funds and mandatory

reinvestment units. If you would like to change your instructions or add additional securities, please contact your broker.

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 3 OF 9

ACCOUNT NUMBER 5WX-44108-93 hSM

IpcAq daDlU

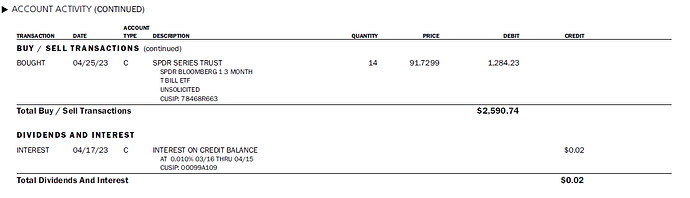

ACCOUNT ACTIVITY (CONTINUED)

ACCOUNT

TRANSACTION DATE TYPE DESCRIPTION QUANTITY PRICE DEBIT CREDIT

BUY / SEL L T R ANSACT I ON S (continued)

BOUGHT 04/25/23 C SPDR SERIES TRUST 14 91.7299 1,284.23

SPDR BLOOMBERG 1 3 MONTH

T BILL ETF

UNSOLICITED

CUSIP: 78468R663

Total Buy / Sell Transactions $2,590.74

DI VI DEN DS AND I NT E RE ST

INTEREST 04/17/23 C INTEREST ON CREDIT BALANCE $0.02

AT 0.010% 03/16 THRU 04/15

CUSIP: 00099A109

Total Dividends And Interest $0.02

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 4 OF 9

ACCOUNT NUMBER 5WX-57521-59 Tus

ztuLH BZIVf

IMPORTANT INFORMATION

Statement of Financial Condition

A copy of Apex Clearing Corporation’s Audited Statement of Financial Condition as of December 31, 2022 is available on the website at www.apexfintechsolutions.com/disclosures/. A copy

may also be obtained at no cost by calling Apex Clearing Corporation. As of December 31, 2022, Apex Clearing Corporation had a net capital of $466,254,287 and was $439,752,615 in

excess of its required net capital of $26,501,672. As of January 31, 2023, Apex Clearing Corporation had a net capital of $503,778,156 and was $479,334,278 in excess of its required net

capital of $24,443,878.

Apex’s Policy for Dividends and Interest

Apex’s policy is to pay all dividends and interest in US Dollars. Apex will allow the following countries to be paid in their foreign currency (Canadian Dollars, British Pounds, Euros, Argentine

Peso, Chinese Renminbi, Korean Won, Philippine Peso and Brazilian Real).

Participation in Fully Paid Lending Program

Customers participating in the Fully-Paid Securities Lending Program should be aware that shares on loan are not covered by FDIC or SIPC. Cash securities collateralizing shares are held at JP

Morgan Chase & Co. and not subject to FDIC or SIPC protections. Please consult the Master Securities Lending Agreement for additional information.

Information Regarding Cost Basis for Foreign Account Statements

Foreign Currency: Cost basis is required to be reported in U.S. dollars for tax purposes. It is the responsibility of the account holder to convert sales proceeds paid in foreign currency to U.S.

dollars to avoid inaccurate cost basis calculations. When reporting the purchase or sale, you must determine the U.S. dollar amounts to be reported as of the settlement date, at the spot rate

or by following a reasonable spot rate convention. See Regulations section 1.6045-1(d)(8).

Payment of Interest to holders of Municipal Securities - you may be subject to a substitute interest payment if the transfer of ownership of your municipal security has not been

completed prior to the next interest payment. Please contact a tax professional for more specific details.

IMPORTANT INFORMATIO N

To our valued customers:

FINRA Rule 2231 requires that we advise you to promptly report any inaccuracy or discrepancy in your account (within 10 days after available) to your brokerage firm and clearing firm (where

these are different firms) and to re-confirm any oral communications in writing.

https://www.finra.org/rules-guidance/notices/06-72

"IMPORTANT - Part of your distribution includes a return of capital. Any distribution that represents a return of capital reduces the estimated per share value shown on your account

statement."

The preceding notice is required when reporting distributions on Direct Participation Programs and/or REITs and is subject to the DPP or REIT sponsor’s final capital return determination as

detailed in the IRS Form 1099 or K-1, as applicable.

Alternative or Other Investments, DPP, and Unlisted securities are not listed on a national securities exchange, are generally illiquid and that, even if a customer is able to sell the securities,

the price received may be less than the per share estimated value provided in the account. The evaluation method used for any particular DPP or REIT will be provided to clients upon request.

Certain positions are not held on Apex’s books or custodied by Apex and are not Protected by SIPC.

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 5 OF 9

ACCOUNT NUMBER 5WX-88162-25 DJw

qHRJn hszKw

ANNOUNCEMENTS (CONTINUED)

Pursuant to SEC Rule 606, Apex Clearing Corporation is required to make publicly available a quarterly report with regard to its routing of non-directed orders. For the purpose of this Rule, we

have entered into an agreement with Quantum5 Market Surveillance (a Division of S3 Matching Technologies) to disclose all required information pertaining to this rule. This information can

be accessed on the internet at: http://public.s3.com/rule606/apex/, or a written copy will be furnished at no cost upon request via telephone to (214) 765-1009.

SEC Rule 606 (b) requires a broker-dealer to disclose to its customers, upon request, "the identity of the venue to which the customer’s orders were routed for execution in the six months prior

to the request, whether the orders were directed orders or non-directed orders, and the time of the transactions, if any, that resulted from such orders."

In accordance with the Emergency Economic Stabilization Act of 2008 broker-dealers are required to track and report cost basis to the IRS in three phases over the next three years.

jEquity securities acquired on or after January 1, 2011

jMutual fund and dividend reinvestment plan (DRIP) shares acquired on or after January 1, 2012:

jDebit securities, options, and all other financial instruments acquired on or after January 1, 2014. (The IRS has extended this date from the previously announced date of January 1, 2013.)

Beginning this upcoming tax reporting season the cost basis of any covered equity security transaction (purchased after 12/31/10) that is required to be reported on a 1099-B will include its

associated cost basis. If you have any questions about this important change to the IRS mandated reporting requirements, please contact your broker-dealer or registered advisor.

IMPORTANT INFORMATION CONTINUED

Please take note of the following description of Apex Clearing Corporation’s excess SIPC coverage, which reflects certain changes made to the coverage effective August 8, 2013. The

Securities Investor Protection Corporation ("SIPC") protects certain customer funds up to a ceiling of $500,000, including a maximum of $250,000 for cash claims. Please note SIPC does

not cover commodity contracts and options on futures. For additional information regarding SIPC coverage, including a brochure, please contact SIPC at (202) 371 - 8300 or visit

www.sipc.org.

Apex has purchased an additional insurance policy to supplement SIPC protection. This additional insurance policy, widely known as ×excess SIPC,Ö becomes available to customers in the

event that SIPC limits are exhausted. This additional insurance provides protection for securities and cash up to an aggregate limit of $150 million, subject to sub-limits for any one

customer of $37.5 million for securities and $900,000 for cash. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities. For

additional information, please contact your broker.

NOTE: Occasionally, Apex Clearing Corporation’s bank deposit sweep program banks

(×Program BanksÖ) may be added or removed from the Program Bank List, which is available on

Apex’s website. Apex will, to the extent possible, update the Program Bank List with any added

Program Banks at least 30 calendar days before making deposits. If a Program Bank is

removed from Apex Clearing Corporation’s bank deposit sweep program (the ×ProgramÖ), it will

no longer be able to receive sweeps of your excess cash balance. If any of your excess cash

balance is at a Program Bank that is removed from the Program, Apex will transfer those funds

into another Program Bank still in the Program or into your Apex Account, at Apex’s discretion.

You may contact your broker to specify any Program Banks into which you do not wish your

excess cash balance to be swept. Please note that if there are insufficient Program Banks

available in the Program, taking into account any from which you have opted out, such that not

all of your excess cash balance can be spread among Program Banks to ensure FDIC

coverage, then some or all of your excess cash balance may remain dormant in your Apex

Account or may be deposited at a Program Bank but not covered by FDIC insurance. You may

obtain additional information on each Program Bank at www.fdic.gov.

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 6 OF 9

ACCOUNT NUMBER 5WX-57955-33 BYE

qndxC OmLNR

ANNOUNCEMENTS (CONTINUED)

You are solely responsible for monitoring the total amount of your assets on deposit with each

Program Bank (including non-Program funds and accounts) in order to determine the extent of FDIC

insurance coverage available to you on those deposits, including Program deposits. Apex shall not

take into account any money you have on deposit at a Program Bank outside of the Program.

A current Program Bank List and current Insured Deposits Terms and Conditions may be found

at https://apexfintechsolutions.com/legal/disclosures/

Coming Soon: Addition of Old National Bank and Flagstar Bank

We are in the process of adding both Old National Bank and Flagstar Bank to the FDIC-Insured Deposit Sweep Program for all eligible accounts. The banks will be eligible to receive deposits

on or before June 1, 2023.

Participating Bank Removal - Signature Bank:

Effective 3/13/2023, Signature Bank was removed as a participating bank from the FDIC-Insured Deposit Sweep Program.

If you have any questions or would like to exclude either bank from receiving your excess cash balance, please reach out to your broker. You are not required to take any action.

FDIC SWEEP PROGRAM

For customers with balances in a bank deposit account as part of the FDIC Sweep Program or shares of a money market mutual fund in which you have a beneficial interest, those balances or

shares may be liquidated on your order and the proceeds returned to your account or remitted to you in accordance with the applicable prospectus and/or Terms and Conditions of the

program.

For customers participating in the FDIC Sweep Program, the FDIC Sweep Program allows your cash balance to be eligible for insurance protection through the FDIC up to the maximum

applicable insurance limits. Customers may obtain information about FDIC, by contacting the FDIC at 1-877-275-3342, 1-800-925-4618 (TDD) or by visiting www.fdic.gov. Deposit Account

balances in the FDIC Sweep Program are not protected by SIPC or any other excess coverage by Apex Clearing Corporation. Deposit Account balances are protected as established by current

applicable laws regulated by the FDIC.

Customers may obtain information about SIPC, including the SIPC brochure, by contacting SIPC at 202-371-8300 or by visiting www.SIPC.org.

IMPORTANT INFORMATION

APEX CLEARING CORPORATION DISCLOSURE STATEMENT

Apex Clearing Corporation ("Apex") recognizes the importance of providing information on an ongoing basis to the customers whose accounts are cleared through Apex. Your broker/dealer has

designated Apex as its clearing firm. In accordance with industry rules and regulations, Apex is required to disclose on an annual basis certain important regulatory notices and disclosures. To

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 7 OF 9

ACCOUNT NUMBER 5WX-63502-84 HzB

yODsQ vaQDK

ANNOUNCEMENTS (CONTINUED)

comply with these requirements, Apex has published an Annual Disclosure Statement which is available on the Apex corporate web site, www.apexclearing.com. For customers who do not

have access to the internet please call Apex at 214-765-1009 and request a complete copy of the Annual Disclosure Statement be mailed to your address of record.

A brief summary of the content of the Annual Disclosure Statement is as follows:

j Anti-Money Laundering - Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account.

j Privacy Policy - The privacy of customers is a responsibility which Apex respects and protects for former customers as well as current customers.

j Margin Disclosure Statement: FINRA Rule 2264 - The Information furnished provides basic facts about purchasing securities on margin and alerts customers of certain risks

involved in trading securities in a margin account.

j Day-Trading Risk Disclosure Statement: FINRA Rule 2270 - Information to be considered before engaging in a day-trading strategy.

j Business Continuity Plan: FINRA Rule 4370 - A further summary of Apex’s Disaster Recovery Plan to reasonable ensure business continuity.

j SEC Rule 606 and 607 (Payment for Order Flow and Order Routing information) - (Rule 606) Requires Apex to make public a quarterly report with regard to routing of

non-directed orders and (Rule 607) Requires Apex to disclose its payment for order flow practices.

j SEC Rule 10b-10 - Requires customers are provided with prior written notification of certain transactions that are not reported immediately through a trade confirmation.

j SIPC Information: FINRA Rule 2266 - The Securities Investor Protection Corporation ("SIPC") requires that funds are available to meet customer claims up to a ceiling of

$500,000, including a maximum of $250,000 for cash claims. For more information about SIPC coverage or to receive a brochure, please visit the SIPC website at www.sipc.org

or, call (202) 371-8300.

j Investor Education and Protection: FINRA Rule 2267 - Requires Apex to provide information about FINRA’s BrokerCheck program. The investor brochure may be obtained from

FINRA BrokerCHeck hotline number (800) 289-9999 or the FINRA web site address www.FINRA.org.

j Joint NASD Industry Breakpoint Task Force - A further summary of a July 2003 report which recommends written disclosure regarding mutual fund breakpoints.

j Carrying Agreements: FINRA Rule 4311 - The firm with which you have opened your securities account has retained Apex to provide certain record keeping, clearance, and

settlement functions. A further summary of details is disclosed.

j Extended Hours Trading Risk Disclosure: FINRA Rule 2265 - Risks to consider include lower liquidity, higher volatility, changing prices, unlinked markets, news announcements,

wider spreads, and lack of calculation.

j Liens and Levies - Apex will abide by the directions of federal, state, or other levying authorities.

j Regulation E - Disclosure regarding certain electronic transfers is required under the provisions of this regulation as issued by the Board of Governors of the Federal Reserve

System.

j Municipal Securities Rulemaking Board ("MSRB") Rule G-10 requires an annual notification that 1) Apex Clearing Corporation is registered with the U.S. Securities and Exchange

Commission and the Municipal Securities Rulemaking Board, 2) the MSRB publishes an investor brochure that is published on their website that describes the protections that may be

provided by the MSRB and how to file a complaint with the regulatory authorities and 3) a copy of the MSRB Investor Brochure as well as information regarding prospective, new and

existing MSRB rules may be found on the MSRB website by going to the following link: http://www.msrb.org/,

IMPORTANT INFORMATION - Privacy Policy

Apex Clearing Corporation ("Apex") carries your account as a clearing broker by arrangement with your broker-dealer or registered investment advisor as Apex’s introducing client. At Apex, we

understand that privacy is an important issue for customers of our introducing firms. It is our policy to respect the privacy of all accounts that we maintain as clearing broker and to protect the

security and confidentiality of non-public personal information relating to those accounts. Please note that this policy generally applies to former customers of Apex as well as current

customers.

Personal Information Collected

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 8 OF 9

ACCOUNT NUMBER 5WX-09300-15 fsR

SCloS fSrwz

ANNOUNCEMENTS (CONTINUED)

In order to service your account as a clearing broker, information is provided to Apex by your introducing firm who collects information from you in order to provide the financial services that

you have requested. The information collected by your introducing firm and provided to Apex or otherwise obtained by Apex may come from the following sources and is not limited to:

j Information included in your applications or forms, such as your name, address, telephone number, social security number, occupation, and income;

j Information relating to your transactions, including account balances, positions, and activity;

j Information which may be received from consumer reporting agencies, such as credit bureau reports;

j information relating to your creditworthiness;

j Information which may be received from other sources with your consent or with the consent of your introducing firm.

In addition to servicing your account, Apex may make use of your personal information for analysis purposes, for example, to draw conclusions, detect patterns or determine preferences.

Sharing of Nonpublic Personal Information

Apex does not disclose non-public personal information relating to current or former customers of introducing firms to any third parties, except as required or permitted by law, including but

not limited to any obligations of Apex under the USA PATRIOT Act, and in order to facilitate the clearing of customer transactions in the ordinary course of business.

Apex has multiple affiliates and relationships with third party companies. Examples of these companies include financial and non-financial companies that perform services such as data

processing and companies that perform securities executions on your behalf. We may share information among our affiliates and third parties, as permitted by law, in order to better service

your financial needs and to pursue legitimate business interests, including to carry out, monitor and analyze our business, systems and operations.

Security

Apex strives to ensure that our systems are secure and that they meet industry standards. We seek to protect non- public personal information that is provided to Apex by your introducing firm

or otherwise obtained by Apex by implementing physical and electronic safeguards. Where we believe appropriate, we employ firewalls, encryption technology, user authentication systems

(i.e. passwords and personal identification numbers) and access control mechanisms to control access to systems and data. Apex endeavors to ensure that third party service providers who

may have access to non-public personal information are following appropriate standards of security and confidentiality. Further, we instruct our employees to use strict standards of care in

handling the personal financial information of customers. As a general policy, our staff will not discuss or disclose information regarding an account except; 1) with authorized personnel of

your introducing firm, 2) as required by law or pursuant to regulatory request, or 3) as authorized by Apex to a third party or affiliate providing services to your account or pursuing Apex’s

legitimate business interests.

Access to Your Information

You may access your account information through a variety of media offered by your introducing firm and Apex (i.e. statements or online services). Please contact your introducing firm if you

require any additional information.

IMPORTANT INFORMATION - Privacy Policy - CONTINUED

Apex may use "cookies" in order to provide better service, to facilitate its customers’ use of the website, to track usage of the website, and to address security hazards. A cookie is a small

piece of information that a website stores on a personal computer, and which it can later retrieve.

Changes to Apex’s Privacy Policy

Apex reserves the right to make changes to this policy.

A C C O U N T S T A T E M E N T

April 1, 2023 - April 30, 2023

PAGE 9 OF 9

ACCOUNT VXUjQl 5WX-36371-61 zqA

WcgmZ pBcjD

ANNOUNCEMENTS (CONTINUED)

How to Get in Touch with Apex about this Privacy Policy

For reference, this Privacy Policy is available on our website at www.apexclearing.com. For more information relating to Apex’s Privacy Policy or to limit our sharing of your personal

information, please contact:

Apex Clearing Corporation

Attn: Compliance Department 350 N. St. Paul St., Suite 1300

Dallas, Texas 75201

cs@apexclearing.com

A C C O U N T S T A T E M E N T