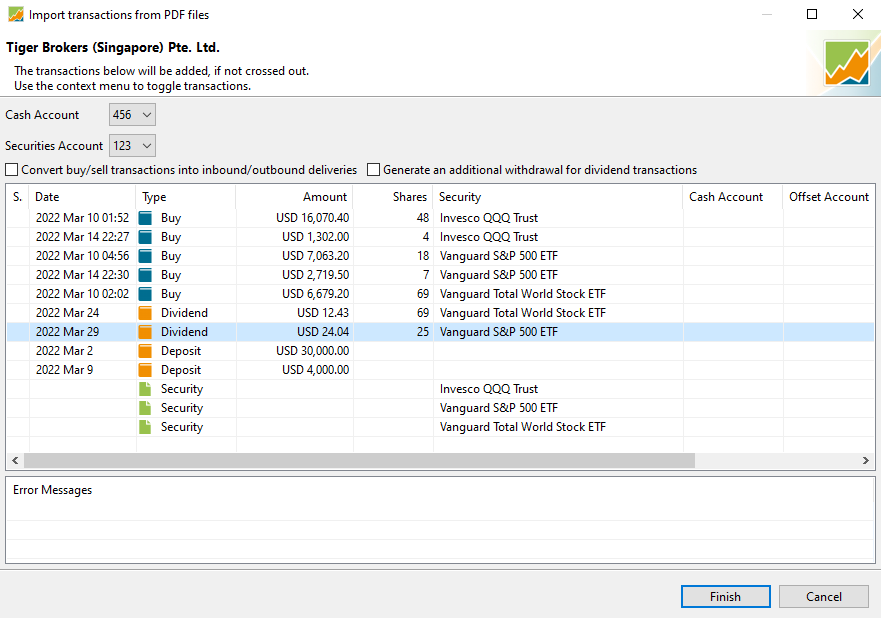

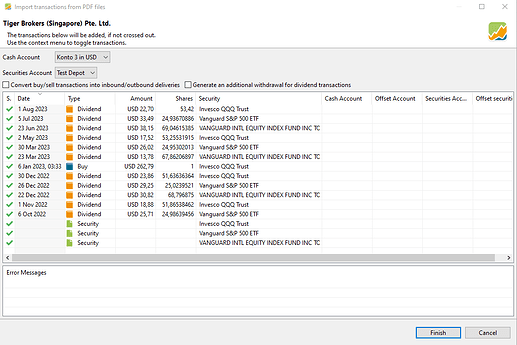

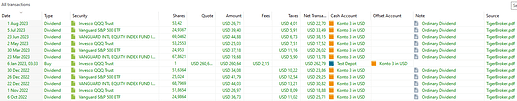

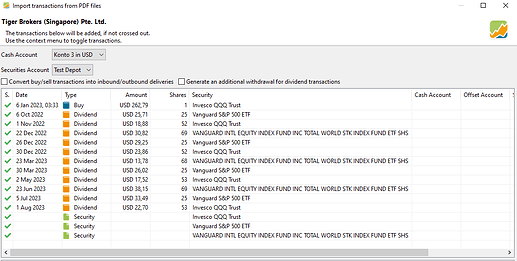

Hello, can you please implement import from Tiger Brokers.

Here is the debug pdf.

Interesting sections are:

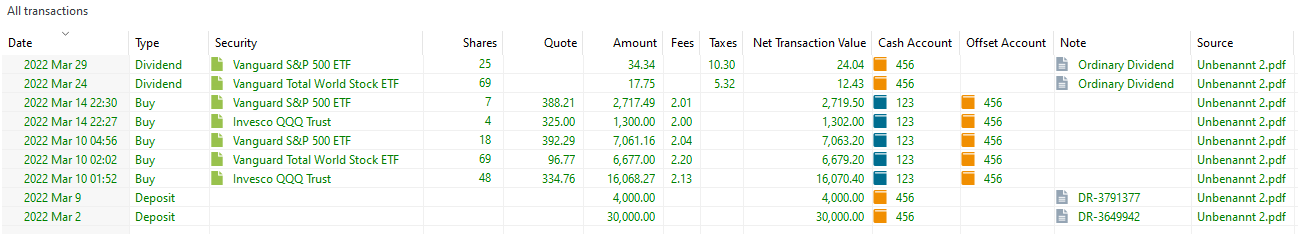

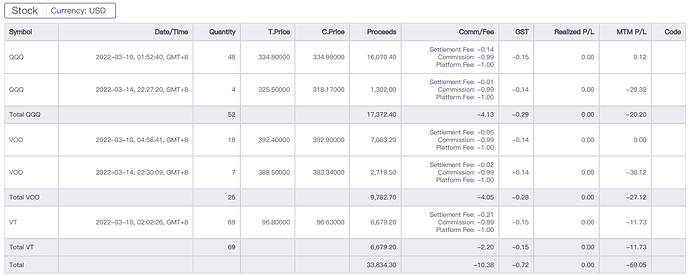

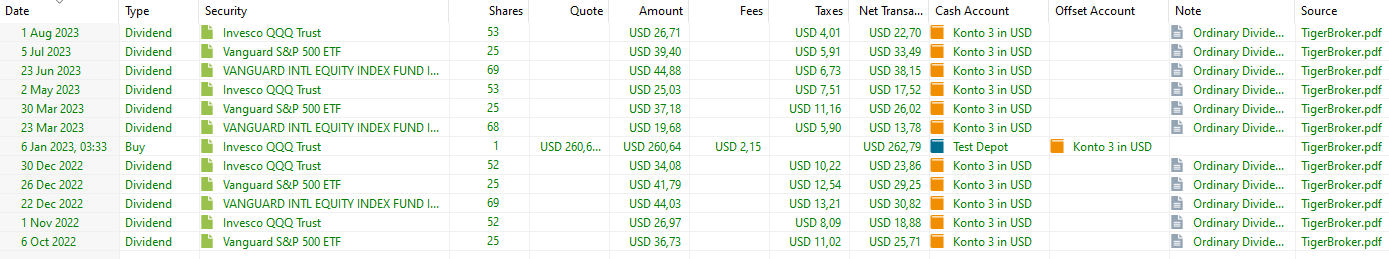

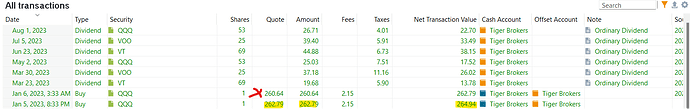

- Trades. As fee please take a sum from “Comm/Fee” and “GST” column. For example for trade of QQQ from 2022-03-10 the fee should be 2.28

- Deposits & Withdrawals

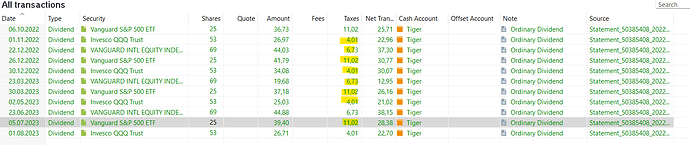

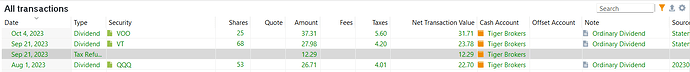

- Sections “Dividends” and “Withholding Tax” should be treated together.

please ignore all the rest

PDFBox Version: 1.8.16

-----------------------------------------

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

John Doe

Account : 123456789 Base Currency : USD

Securities&Futures Asset : 36,427.19USD Account Capabilities : Cash

Address : bla bla

Securities&Futures

Time Weighted Rate Of Return : 7.14%

Total Asset : 36,427.19USD

Cash Report

Currency: USD

Total Securities Futures

Starting Cash 0.00 0.00 0.00

Commissions -4.95 -4.95

Platform Fees -5.00 -5.00

GST -0.72 -0.72

Deposits 34,000.00 34,000.00

Dividends 52.09 52.09

Net Trades (Purchase) -33,834.30 -33,834.30

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 1/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Total Securities Futures

Settlement Fees -0.43 -0.43

Withholding Tax -15.62 -15.62

Ending Cash 191.07 191.07 0.00

Ending Settled Cash 191.07 191.07 0.00

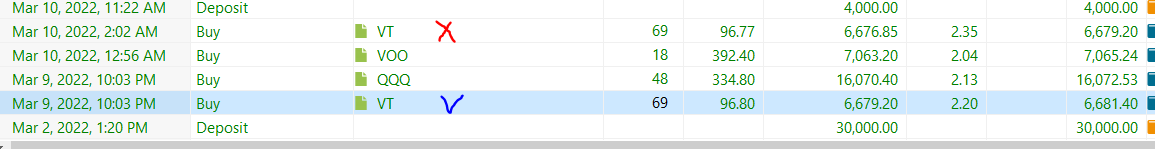

Trades

Stock Currency: USD

Symbol Date/Time Quantity T.Price C.Price Proceeds Comm/Fee GST Realized P/L MTM P/L Code

Settlement Fee: -0.14

QQQ 2022-03-10, 01:52:40, GMT+8 48 334.80000 334.99000 16,070.40 Commission: -0.99 -0.15 0.00 9.12

Platform Fee: -1.00

Settlement Fee: -0.01

QQQ 2022-03-14, 22:27:20, GMT+8 4 325.50000 318.17000 1,302.00 Commission: -0.99 -0.14 0.00 -29.32

Platform Fee: -1.00

Total QQQ 52 17,372.40 -4.13 -0.29 0.00 -20.20

Settlement Fee: -0.05

VOO 2022-03-10, 04:56:41, GMT+8 18 392.40000 392.90000 7,063.20 Commission: -0.99 -0.14 0.00 9.00

Platform Fee: -1.00

Settlement Fee: -0.02

VOO 2022-03-14, 22:30:09, GMT+8 7 388.50000 383.34000 2,719.50 Commission: -0.99 -0.14 0.00 -36.12

Platform Fee: -1.00

Total VOO 25 9,782.70 -4.05 -0.28 0.00 -27.12

Settlement Fee: -0.21

VT 2022-03-10, 02:02:26, GMT+8 69 96.80000 96.63000 6,679.20 Commission: -0.99 -0.15 0.00 -11.73

Platform Fee: -1.00

Total VT 69 6,679.20 -2.20 -0.15 0.00 -11.73

Total 33,834.30 -10.38 -0.72 0.00 -59.05

Transaction Fees

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 2/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Transaction Fees

Stock Currency: USD

Date/Time Symbol Description Quantity Trade Price Amount

2022-03-10, 01:52:40, GMT+8 QQQ Invesco QQQ Trust 48 334.8000 -0.14

2022-03-10, 02:02:26, GMT+8 VT Vanguard Total World Stock ETF 69 96.8000 -0.21

2022-03-10, 04:56:41, GMT+8 VOO Vanguard S&P 500 ETF 18 392.4000 -0.05

2022-03-14, 22:27:20, GMT+8 QQQ Invesco QQQ Trust 4 325.5000 -0.01

2022-03-14, 22:30:09, GMT+8 VOO Vanguard S&P 500 ETF 7 388.5000 -0.02

Total -0.43

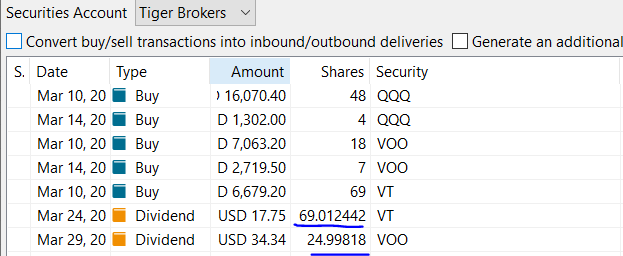

Deposits & Withdrawals

Currency: USD

Date Description Bank Bank Account Amount

2022-03-02 Deposit DR-3649942 30,000.00

2022-03-09 Deposit DR-3791377 4,000.00

Total 34,000.00

Open Positions

Stock Currency: USD

Symbol Quantity Mult Cost Price Cost Basis Close Price Settle Price Value Unrealized P/L

QQQ 52 1 334.1696154 17,376.82 362.54000 18,852.08 1,475.26

VOO 25 1 391.4812000 9,787.03 415.17000 10,379.25 592.22

VT 69 1 96.8340580 6,681.55 101.29000 6,989.01 307.46

Total 33,845.40 36,220.34 2,374.94

Dividends

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 3/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Dividends

Currency: USD

Date Description Amount

2022-03-24 VT Cash Dividend 0.2572 USD per Share (Ordinary Dividend) 17.75

2022-03-29 VOO Cash Dividend 1.3737 USD per Share (Ordinary Dividend) 34.34

Total 52.09

Withholding Tax

Currency: USD

Date Description Amount

2022-03-24 VT Cash Dividend 0.2572 USD per Share - Tax -5.32

2022-03-29 VOO Cash Dividend 1.3737 USD per Share - Tax -10.30

Total -15.62

Change in Dividend Accruals

Currency: USD

Symbol Date Ex Date Pay Date Quantity Tax GST Fee(include ADR) Gross Rate Gross Amount Net Amount Code

QQQ 2022-03-21 2022-03-21T00:00-04:00[US/Eastern] 2022-04-29T00:00-04:00[US/Eastern] 52 6.77 0.00 0.00 22.55 15.78

VT 2022-03-21 2022-03-21T00:00-04:00[US/Eastern] 2022-03-24T00:00-04:00[US/Eastern] 69 5.32 0.00 0.00 17.75 12.43

VOO 2022-03-24 2022-03-24T00:00-04:00[US/Eastern] 2022-03-29T00:00-04:00[US/Eastern] 25 10.30 0.00 0.00 34.34 24.04

Total 22.39 0.00 0.00 74.64 52.25

GST

Currency: USD

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 4/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Date Description Amount Converted to SGD

2022-03-09 COMMISSION@GST -0.15 -0.20

2022-03-09 COMMISSION@GST -0.15 -0.20

2022-03-09 COMMISSION@GST -0.14 -0.19

2022-03-14 COMMISSION@GST -0.14 -0.19

2022-03-14 COMMISSION@GST -0.14 -0.19

Total -0.72 -0.98

Financial Instrument Information

Stock

Symbol Issuer Description Multiplier Expiry Strike Right

QQQ Invesco QQQ Trust 1

VOO Vanguard S&P 500 ETF 1

VT Vanguard Total World Stock ETF 1

Base Currency Exchange Rate

Date 2022-03-31

USD 1

AUD 0.74836

CAD 0.79949

CNH 0.15736

EUR 1.10658

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 5/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Date 2022-03-31

GBP 1.31431

HKD 0.12767

JPY 0.00822

NZD 0.69335

SGD 0.73784

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 6/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

Annotation

1.Accrued dividends: when the company declares the dividends of shares, this part will calculate the dividends to be paid to the account, and the dividends paid to the account during form checking period will be included into cash.

2.Accrued interest: interest is charged on a monthly basis, so this part will calculate the total interest earned by the account during the statement period, not including the interest received.

3.Time-weighted rate of return: the rate of return within the range (except for outgoing and incoming funds)

4.Net Trades (Sales): Cash from selling securities

5.Net Trades (Purchase): Cash spent on buying securities

6.Transaction Fees: Including transaction levy and stamp duty

7.Other Fees: Including ADR fees, IPO fees, withdraw fees, dividends and other expenses.

8.Withholding Tax: Hong Kong stocks dividend tax

9.Segment Transfer: The transfer of funds between securities and futures

10.Accrued reversing: the interest actually received by the user during the statement checking period.

11.Multiplier: in an individual stock option or futures transaction, the value of the contract is expressed as the product of a certain monetary amount and the underlying index. The certain monetary amount is fixed by the contract,

which is referred to as the contract multiplier. At present, the stock is 1 by default and the individual stock option is 100.

12.Settle Price: Futures settlement price is not equal to the closing price, futures is based on the settlement price to calculate the profit and loss of position.

13.Proceeds: Trading amount is trading price multiplied by trading volume

14.Accrued reversing: the interest actually received by the user during the statement checking period.

15.Comm/Fee: In the trades module, for trades before December 2021, 'commission' includes commission + platform fee + transaction levy + stamp tax + transaction fee + settlement fee, etc. For trades after December 2021,

'commission' only includes commission, and other expenses are shown separately.

16.Custodian fees: no charge, $0

17.Exchange rate: You could view U.S. Dollar Currency Index chart to see the exchange rate at the last day for searching. (USD is transaction currency)

18.Transaction is based on FIFO method

19.Futures' Starting Cash and Ending Cash represents the starting and ending asset value of futures account, the difference between Starting and Ending Cash includes changes in position value and cash transactions (not showing

up on statement)

Notes

1.Please examine the details in the monthly statement and promptly report any inaccuracy or discrepancy found to service@tigerbrokers.com.sg within 14 calendar days from the date of the statement. All the above details shall be

deemed correct and conclusive if no written notice of objection is received by us within 14 days from the date of the monthly statement.

2.Tiger Brokers (Singapore) Pte Ltd is a member of Financial Institutions Dispute Resolution Centre (FIDReC), which is an independent and impartial institution specialising in the resolution of disputes between financial institutions

and consumers. Unresolved issues can also be brought up to FIDReC at www.fidrec.com.sg for mediation.

3.Information on our fees can be found at https://www.tigerbrokers.com.sg/commissions/fees

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 7/8

Tiger Brokers (Singapore) PTE.LTD.

Activity Statement : 2022.03.02 - 2022.03.31

4.Information regarding your account can be found in the Terms and Conditions at https://www.tigerbrokers.com.sg/info/terms-n-conditions

5.Customer money and assets are deposited in trust and held in custody, respectively in accordance with the Securities and Futures (Licensing and Conduct of Business) Regulations, governing the protection of client money and

assets.

Address: 50 Raffles Place, #29-04 Singapore Land Tower, Singapore 048623. 8/8