Hello

after about a month of using this excellent software, I would like to say that I feel the lack of a performance calculation that takes into account only the capital gain/loss realized and the dividends received. In a period in which the nominal value of many investments is at a loss, it would be interesting to have a measure of performance that excludes unrealized (and therefore theoretical) capital loss/gain due to the current price but only takes into account realized dividends and profits.

Is it a miss just for me?

be aware of mental accounting:

If you realize a profit on A, then immediately reinvest all proceeds into B and the new investment B is now under water with cummulative performance A+B being 0% - why would you show positive performance?

Thanks for the reply.

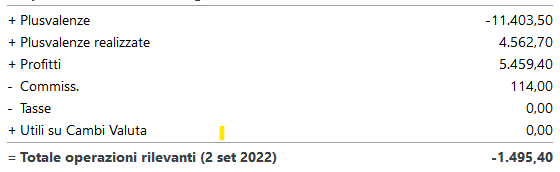

I’ll reverse the question, why looking at the attached photo should I think that this is just a negative performance?

Of course, if we evaluate the performance of the portfolio it is correct to have an IRR of -0.81% also considering the loss of € 11k.

But this loss is theoretical, and for this reason I would also like to have a second performance calculation that takes into account only the 10k€ of profits/losses that have actually been realized and therefore an IRR that considers only the cash flows that really occurred.

Who says you should think that?

Makes no sense in my opinion.

another inconsistency: you cannot count dividends as gains and then say the corresponding loss when the shares go ex-dividend is theoretical.

I can understand that unrealized losses may reverse over time into gains, but this does not change the current market value of your positions. You could simply edit all prices to reflect the cost basis and you will see what you want. Then you have to change back. But I do not see the utility of this calculation.

You can easily show all dividends in portfolio performance and compare with past years.

ok, I understand your point of view

thanks for your feedback