Hi,

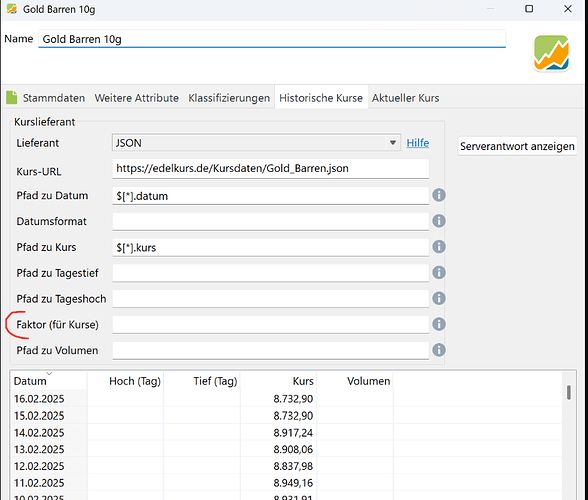

I was able to get the physical gold prices using the directions in the How-To’s. Great.

Any ideas on how I would take into account the difference between the gold price and what would be a typical local selling price.

For example there would be about a 5-10% spread.

Is there a way for me to add this so that my current portfolio value is netted for that?

So for example if I have 10 coins, each coin is 1oz. Let’s say the value of 1 oz Gold is 5000.

Instead of it showing 10x5,000 = 50,000 I would want it to show 10 x 4,500 (assuming 10% spread).

Any ideas? Thank you