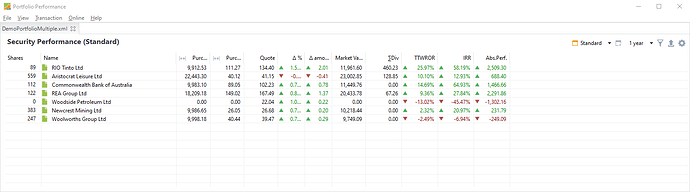

The Security Performance report gives the best detailed overview of the numbers. I’m interested in how to do the following or any workarounds.

Q1. Can the report be swiped with a mouse and copied into the clipboard (quicker than download/open)?

A1. No, not in Version: 0.54.2 (Jul. 2021) (see Copy Object to Clipboard · Issue #2372 · buchen/portfolio · GitHub). It normally works in any software so I don’t understand why not in PP.

Q2. Can column totals be displayed?

A2. It’s not directly supported in Version: 0.54.2 (Jul. 2021) (see Absolute Performance % average (and column totals) · Issue #1906 · buchen/portfolio · GitHub). Use the csv export icon, import into a spreadsheet and calculate as required.

The entire portfolio is displayed below:

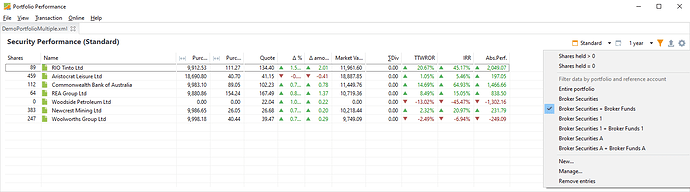

Then filtered (eg Assets, Holdings, Calculation, Securities, Income & Expense) by the Main Portfolio (notice RIO and REA shared reduce to 89 and 64 respectively):

Q3. Can dividends in Bank be included in this report?

A3. Yes, View Report, Click Filter icon, New, Ctrl-Click to select accounts, Enter Name, OK. Remove entries is savage, removes all custom filters without warning!

Q4. Is there a better way to setup Accounts and Portfolios? It looks like a contra account will be needed to show payments for one fiscal year made in the next.

DemoPortfolioMultiAcc.xml created by importing the following csv files into the accounts that follow (checking date format):

DemoPortfolioMultiAcc.csv

Date,Settlement,Type,Note,Ticker Symbol,Security Name,Shares,Average Price,Consideration,Fees,Value,Cash Account,Securities Account

04/01/21,06/01/21,Buy,T20210104689951-1,REA.AX,REA Group Ltd,64,154.24,9871.36,9.5,9880.86,Broker Funds,Broker Securities

01/02/21,03/02/21,Buy,T20210201523636-1,RIO.AX,RIO Tinto Ltd,89,111.27,9903.03,9.5,9912.53,Broker Funds,Broker Securities

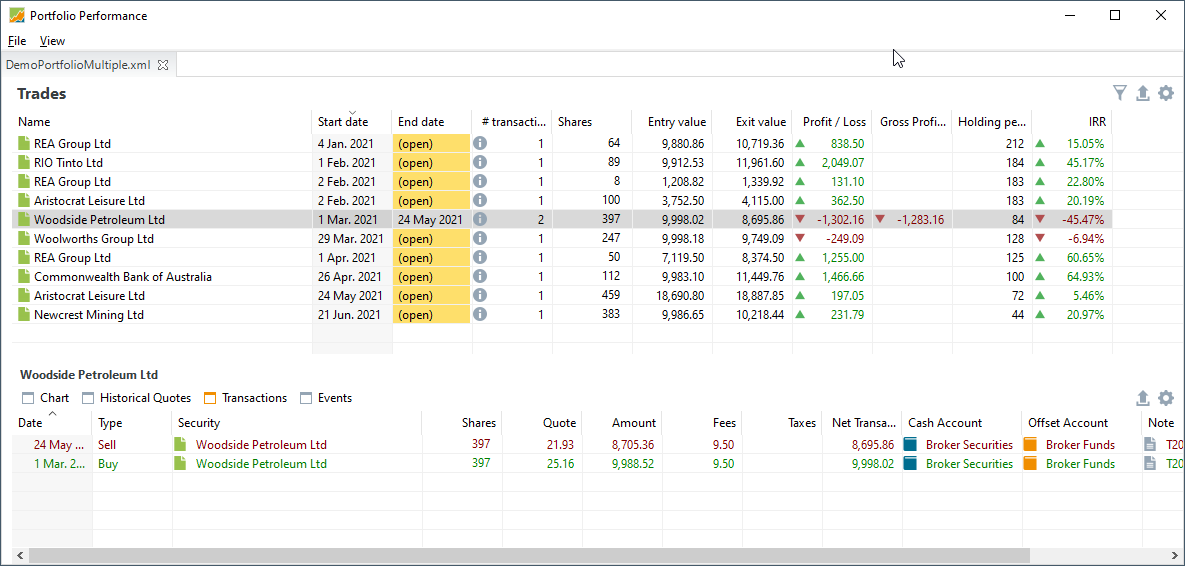

01/03/21,03/03/21,Buy,T20210301378143-1,WPL.AX,Woodside Petroleum Ltd,397,25.16,9988.52,9.5,9998.02,Broker Funds,Broker Securities

29/03/21,31/03/21,Buy,T20210329345452-1,WOW.AX,Woolworths Group Ltd,247,40.44,9988.68,9.5,9998.18,Broker Funds,Broker Securities

26/04/21,28/04/21,Buy,T20210426460841-1,CBA.AX,Commonwealth Bank of Australia,112,89.05,9973.6,9.5,9983.1,Broker Funds,Broker Securities

24/05/21,26/05/21,Sell,T20210524608678-1,WPL.AX,Woodside Petroleum Ltd,397,21.88,8686.36,9.5,8695.86,Broker Funds,Broker Securities

24/05/21,26/05/21,Buy,T20210524356856-1,ALL.AX,Aristocrat Leisure Ltd,459,40.7,18681.3,9.5,18690.8,Broker Funds,Broker Securities

21/06/21,23/06/21,Buy,T20210621600557-1,NCM.AX,Newcrest Mining Ltd,383,26.05,9977.15,9.5,9986.65,Broker Funds,Broker Securities

02/02/21,04/02/21,Buy,T20210202523681-1,REA.AX,REA Group Ltd,8,152.29,1218.32,9.5,1208.82,Broker Funds A,Broker Securities A

02/02/21,04/02/21,Buy,T20210202869586-1,ALL.AX,Aristocrat Leisure Ltd,100,37.62,3762,9.5,3752.5,Broker Funds A,Broker Securities A

01/04/21,03/04/21,Buy,T20210403855861-1,REA.AX,REA Group Ltd,50,142.58,7129,9.5,7119.5,Broker Funds 1,Broker Securities 1

DemoDistributionsMultiAcc.csv

Date,Ticker Symbol,Shares,Value,Franking,Total,Cash Account,Securities Account

23/03/21,REA.AX,64,37.76,16.19,53.95,Bank,Broker Securities

15/04/21,RIO.AX,89,460.23,197.24,657.47,Bank,Broker Securities

2/07/21,ALL.AX,459,68.85,29.51,98.36,Bank,Broker Securities

23/03/21,REA.AX,50,29.50,12.64,42.14,Bank A,Broker Securities A

2/07/21,ALL.AX,400,60.00,25.72,85.72,Bank A,Broker Securities A

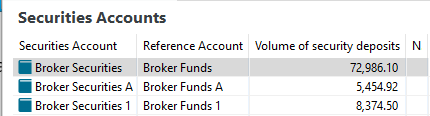

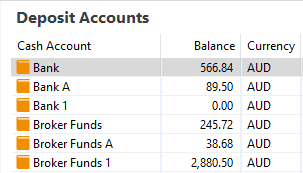

Deposits:

- BrokerFunds, 1/1/2021, $70,000

- BrokerFunds A, 1/2/2021, $5,000

- BrokerFunds 1, 1/4/2021, $10,000