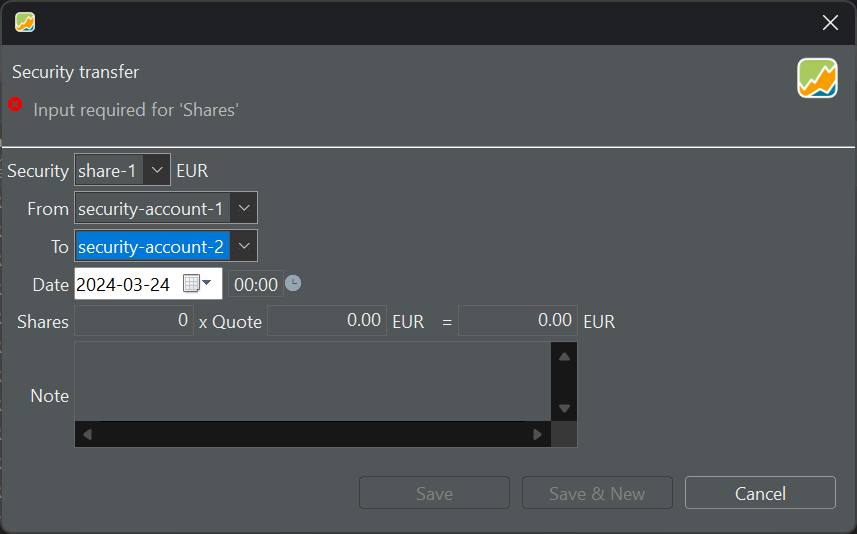

Transferring securities from one account to another assumes a quoted price (see figure). When might this be beneficial? I assumed the Transfer function was solely intended for moving securities (keeping the historical prices) . If a new quote is indeed required, could this be simulated with a Delivery (Outbound), followed by a Delivery (Inbound)? This approach would also allow for the inclusion of taxes and fees.

The price is needed in order to calculate the performance of the depot. The price you set here has no influence on the gain when selling.

In real life the original price is moved as well.

But this would then be a contraindication for the depot performance.

That’s why’s important to not simply delete a depot at least in most cases. Unless you know how to deal with it.

Cheers

Thanks for your response. Unfortunately, I don’t fully understand it. I thought that a possible use case for a security transfer could be the following: as a parent, you have purchased some stock (located in a security account, called parent). Later, you want to reserve some part of this stock for your child. So, you move a few shares to a security account child. This way, both accounts could be monitored separately, and for instance, selling stock from your parent account will not influence the child account. But why is a new quote price necessary when moving the stock to the child account?

You argued that it’s needed for performance calculation. I see that now. In this case, the quote of the Security transfer is used in the performance calculation of the child account. But, what do you mean by “contra indication”? Why can’t the original buying price be taken? As you said, this quote has no influence on the gain when selling. I also noticed that as a result of the transfer, two open trades are created (for the parent & child). The start date however is the original date of the purchase, both for child & parent.

Your understanding is perfectly right.

Your proposal is just a different way to handle a transfer.

That’s why I said. Unless you know what you are doing. And you do know ![]()

When someone is tracking assets only and does not care the depot performance he can set the original purchase price.

So in summary it’s a question about which KPI’s are important and which of those must be kept.

For instance if someone wants to switch to new broker you can transfer all assets with the purchase price or just rename the depot or make use of Inbound/Outbound.

On a close view transfers in PP are not as simple as most people think.

Hope that helps.

Cheers