Dear developers,

Can you please implement import from ScorePriority Inc

Here is the example of the monthly statement:

PDF author: ''

PDFBox Version: 1.8.16

-----------------------------------------

Score Priority Corp. ACCOUNT NUMBER: 12345678

One Penn Plaza, 16th FL, Suite 1614

New York, NY 10119 Return Service Requested STATEMENT PERIOD: September 1 - 30, 2021

FINANCIAL ADVISOR: Score Priority Corp.

ACCOUNT STATEMENT FOR QUESTIONS CALL: 855.274.4934

support@scorepriority.com

IMPORTANT REMINDER: For U.S. taxpayers who are 72 and older, the IRS

requires that you withdraw a sufficient amount from your IRA to satisfy the

minimum distribution requirements by Friday, December 31, 2021. Failure to

withdraw this minimum could result in a tax liability. All documents should be John Doe

received by Vision no later than Friday, December 3, 2021 in order to avoid Great Street 31-23

late fees and ensure timely processing of your request. Please consult your tax Some City, 1, 22221

advisor for assistance with this matter. If you do not have an IRA and are

interested in more information, please call your Account Representative.

Asset Allocation

Total Assets AllocationPercentage

Total Portfolio $93,500.73 Cash & Cash Equivalents $113.70 0.12%

Equities $93,387.03 99.88%

Account Value Summary Total Portfolio $93,500.73 100.00%

Beginning Value as of August 31 ................................................... $97,557.45

Net Additions .......................................................................................... 1,149.95 Cash & Cash Equivalents 0.12%

Net Withdrawals .................................................................................... (2,212.32)

Change In Investment Value ................................................................. (2,994.35)

Ending Value as of September 30 ................................................... $93,500.73

Income Summary

Description Current Year to Date

Dividends $17.56 $468.92

Credit Interest $0.00 $1.44 Equities 99.88%

Dividend Withheld ($0.31) ($0.31)

Accounts are introduced by Score Priority Corp. and carried by Vision Financial Markets LLC, a SEC-registered broker/dealer, member FINRA and SIPC.

Page 1 of 6

ACCOUNT NUMBER: 12345678

John Doe STATEMENT PERIOD: September 1 - 30, 2021

Account Activity Summary Gain / Loss Summary

Unrealized Gain / Loss Current Year to Date

Assets bought .......................................................................................... ($2,207.72) Long-Term

Assets sold/redeemed ............................................................................... $1,132.39 Equities $1,428.57 $1,428.57

Dividends taxable/non-taxable ....................................................................... $17.56 Total Unrealized Gain / Loss $1,428.57 $1,428.57

Withholding ..................................................................................................... ($4.60)

Cash Management Summary

Current Year to Date

Deposits $0.00 $20,029.98

Income and Distributions $17.56 $470.36

Securities Sold and Redeemed $1,132.39 $24,731.01

Net Additions To Cash $1,149.95 $45,231.35

Withdrawals ($4.60) ($139.93)

Securities Purchased ($2,207.72) ($115,978.02)

Net Subtractions From Cash ($2,212.32) ($116,117.95 )

Total Cash / Funds on September ($1,062.37) ($70,886.60)

30

Page 2 of 6

ACCOUNT NUMBER: 12345678

John doe STATEMENT PERIOD: September 1 - 30, 2021

Cash & Cash Equivalents 0.12%

Description Quantity Market Adjusted Cost / Current EstimatedPrice Market Value Original Cost Yield Annual Income

Cash

US Dollar 113.70 1.00 113.70 113.70 0.00 0.00

Total Cash & Cash Equivalents $113.70 $113.70 $0.00

Equities 99.88%

Symbol Description Quantity MarketPrice Market Value Unit Cost Cost Basis

Unrealized Div Estimated

Gain (Loss) Yield % Annual Income

PPLT Aberdeen Std Platinum Etf Tr 3 90.200 270.60 98.13 294.40 (23.80)

APEI American Public Education Inc 10 25.610 256.10 26.50 265.00 (8.90)

GOLD Barrick Gold Corp 18 18.050 324.90 20.82 374.72 (49.82) 1.99 6.48

BLUE Bluebird Bio Inc 16 19.110 305.76 41.57 665.16 (359.40)

JETS Etf Ser Solutions 14 23.630 330.82 25.81 361.30 (30.48)

ET Energy Transfer Operating L P 200 9.580 1,916.00 7.09 1,419.00 497.00 6.36 121.99

QQQ Invesco QQQ Tr 85 357.960 30,426.60 310.59 26,400.00 4,026.60 0.49 150.18

IEMG Ishares Inc 400 61.760 24,704.00 66.25 26,500.70 (1,796.70) 1.93 477.60

MRK Merck & Co Inc New 9 75.110 675.99 74.10 666.90 9.09 3.46 23.40

PLTR Palantir Technologies Inc 4 24.040 96.16 23.95 95.80 0.36

O Realty Income Corp 22 64.860 1,426.92 59.14 1,301.16 125.76 4.36 62.30

GLD Spdr Gold Trust 82 164.220 13,466.04 180.02 14,761.78 (1,295.74)

XLF Select Sector Spdr Tr 40 37.530 1,501.20 34.75 1,390.00 111.20 1.61 24.19

TTWO Take-two Interactive Software 10 154.070 1,540.70 176.74 1,767.42 (226.72)

TEVA Teva Pharmaceutical Inds Ltd 40 9.740 389.60 11.22 448.80 (59.20)

TSN Tyson Foods Inc 6 78.940 473.64 78.00 468.00 5.64 2.25 10.68

VDE Vanguard World Fds 20 73.900 1,478.00 76.69 1,533.88 (55.88) 3.88 57.43

Continued on next page

Page 3 of 6

ACCOUNT NUMBER: 12345678

John Doe STATEMENT PERIOD: September 1 - 30, 2021

Equities (Continued from previous page)

Symbol Description Quantity MarketPrice Market Value Unit Cost Cost Basis

Unrealized Div Estimated

Gain (Loss) Yield % Annual Income

VOO Vanguard Index Fds 35 394.400 13,804.00 378.41 13,244.44 559.56 1.34 185.04

Total Equities $93,387.03 $91,958.46 $1,428.57 $1,119.29

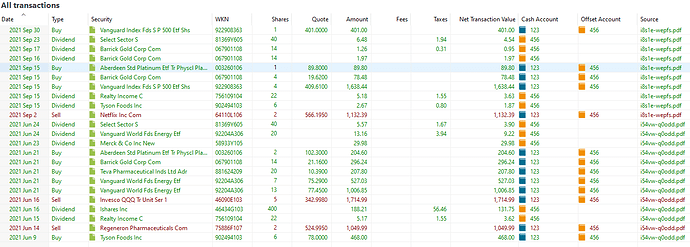

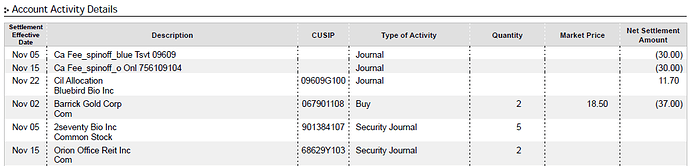

Account Activity Details

Settlement

Effective Description CUSIP Type of Activity Quantity Market Price Net Settlement

Date Amount

Sep 02 Netflix Inc 64110L106 Sell 2 566.20 1,132.39

Com

Sep 15 Aberdeen Std Platinum Etf Tr 003260106 Buy 1 89.80 (89.80)

Physcl Platm Shs

Sep 15 Barrick Gold Corp 067901108 Buy 4 19.6199 (78.48)

Com

Sep 15 Vanguard Index Fds 922908363 Buy 4 409.61 (1,638.44)

S P 500 Etf Shs

Sep 16 Barrick Gold Co 067901108 Return of Capital (1.26)

Sep 16 Barrick Gold Co 14 067901108 Dividend 1.97

Sep 16 Barrick Gold Co 14 067901108 Return of Capital 1.26

Sep 17 Barrick Gold Co 14 067901108 Dividend 1.26

Sep 17 For Sec Withhold: Div .25000 067901108 Foreign Withholding (0.31)

Barrick Gold Corp

Sep 15 Realty Income C 22 756109104 Dividend 5.18

Sep 15 Nra Withhold: Dividend 756109104 NRA Withhold (1.55)

Realty Income Corp

Sep 15 Tyson Foods Inc 6 902494103 Qualified Dividend 2.67

Sep 15 Nra Withhold: Dividend 902494103 NRA Withhold (0.80)

Tyson Foods Inc

Continued on next page

Page 4 of 6

ACCOUNT NUMBER: 12345678

Hojn Doe STATEMENT PERIOD: September 1 - 30, 2021

Account Activity Details (Continued from previous page)

Settlement

Effective Description CUSIP Type of Activity Quantity Market Price Net Settlement

Date Amount

Sep 23 Select Sector S 40 81369Y605 Dividend 6.48

Sep 23 Nra Withhold: Dividend 81369Y605 NRA Withhold (1.94)

Select Sector Spdr Tr

Sep 30 Vanguard Index Fds 922908363 Buy 1 401 (401.00)

S P 500 Etf Shs

Page 5 of 6

General Information Tax Information

This account statement contains important information about your brokerage account carried and cleared If you are subject to 1099 reporting, all applicable 1099 Forms will be provided at year end. For 1099B

by Vision Financial Markets LLC. Please review this statement carefully. If you disagree with any transaction, purposes, proceeds of sales, redemptions or exchanges of securities will be reported to the Internal

if there are any errors, omissions or discrepancies on this statement, or if you do not understand any of the Revenue Service on a trade date basis. To avoid backup withholding, we must be in receipt of Form W-9.

information in this statement, please contact your Financial Advisor or your brokerage firm, in writing Cost data and realized capital gains and losses are provided for informational purposes only. Please review

immediately, or contact us orally and reconfirm in writing. If you do not object to the accuracy of the for accuracy. We are not responsible for omitted or restated data. Please consult your tax advisor to

information reported on this statement within 10 business days, we will consider it conclusive. In other words, determine the tax consequences of your securities transactions. Vision Financial Markets LLC is not a

by failing to object within 10 business days of the date of this statement, you agree that you have ratified as registered tax advisor.

accurate all of the transactions and activities reported in this statement. If this statement shows that we have

mailed or delivered security certificate(s) that you have not received, notify us immediately in writing. We will Portfolio Pricing

arrange for a stop order and replacement certificate(s). If you do not notify us promptly, you may be

responsible for contacting the transfer agent directly for replacement. Inquiries concerning positions and Market Value of your account is the value of your settled positions for which the quotation services were

balances in your account may be directed to your Financial Advisor or Vision Financial Markets, Attention: able to obtain closing prices and/or the mean bid and ask price on the statement date. Because of the

Chief Compliance Officer, 120 Long Ridge Road, 3 North, Stamford, CT 06902- 1839. All other inquiries or nature of the data provided by the quotation services, the accuracy of such prices cannot be guaranteed.

complaints regarding your account or the activity therein should be directed to the address and number listed Those securities for which prices are not available are not included in the market value calculation and are

on the front of this statement. shown as unpriced on the statement. Figures are subject to change at any time and they should not be

relied upon for investment or trading decisions.

All transactions are subject to the rules, regulations, requirements (including margin requirements) and

customs of the Federal Reserve Board, the Securities and Exchange Commission, the exchange or market (and Transaction Charges

its clearing house, if any) where executed, and any association whose rules and regulations govern

transactions in said market, and to all the terms of your customer account agreement, and all written Further information with respect to commissions and other charges related to the execution of listed

agreements between you and us. options and other transactions has been included in confirmation of such transactions previously furnished

to you and such information will be made available to you promptly upon request.

If this is a margin account, this is a combined statement of your general account and of a special memorandum

account maintained for you under Section 220.6 of Regulation T issued by the Board of Governors of the Credit and Debit Interest

Federal Reserve System. The permanent record of the special memorandum account as required by If you participate in our money market sweep program, funds are swept automatically from available free

Regulation T is available for your inspection upon request.

credit balances into a selected money market fund. Money fund balances must earn at least $0.01 per day

All transactions are reported on a trade- date basis. Security and cash position balances will reflect trades of interest in order to be credited on a monthly basis. Free credit balances created by check and other

executed but not settled as of the date of the current statement. deposits are subject to a hold prior to earning interest. We charge debit interest as permitted according to

our customer account agreement. The debit interest rate is subject to change without prior notice based on

Any free credit balance represents funds payable upon demand (subject to any open commitments in your changes in the broker call rate. Debit interest is calculated on a settlement date basis, with free credit

account) which, although properly accounted for on our books of record, are not segregated, unless federal balances offset against any debit balances, and the interest is calculated on the average daily net debit

and/or state law compliance dictates otherwise, and may be used in the conduct of our business. balance based on a 360- day basis, accrued from the next to last business day of the prior month to the

second to last business day of the current month.

Our financial statement is available upon written request.

Change of Address

Statements will be mailed monthly to customers who have transactions affecting money balances and/or Please notify your Financial Advisor or your brokerage firm promptly of any changes in your address or

security positions. All other accounts will receive statements quarterly as long as the account contains a contact information. Failure to notify us, and our resulting inability to send you important notifications,

money or security balance. Please retain this statement for your records, as it contains information that may could result in restrictions or other issues in your account.

be needed to verify entries appearing on subsequent statements or for income tax purposes. A charge may be

incurred by you should duplicate copies of statements be requested at a later date. Securities Investor Protection Corporation (SIPC) and Excess SIPC Coverage

Short Account Balances We are a member of the Securities Investor Protection Corporation (SIPC), which protects the client assets

of its members up to $500,000 (including a maximum of $250,000 for claims for cash). An explanatory

We maintain all securities sold short in a segregated short account. These securities are marked- to-market, brochure is available upon request and by visiting http://www.sipc.org.

and we transfer any increase or decrease from the short sale price to your margin account on a weekly basis.

We represent your short account balance as the balance of your short account as of the last weekly market-to- PROMPTLY ADVISE YOUR FINANCIAL ADVISOR OR YOUR BROKERAGE FIRM IN WRITING OF ANY

market, not as of the statement end date. MATERIAL CHANGES IN YOUR INVESTMENT OBJECTIVES OR FINANCIAL SITUATION OR IF THIS

STATEMENT IS NOT IN ACCORDANCE WITH YOUR RECORDS.

Custody of Securities

Fully paid for securities held by us for you, but which are not registered in your name, may be commingled with

identical securities being held for other clients by us, or the Depository Trust and Clearing Company or similar

depositories. Securities held for accounts of customers with outstanding obligations, or deposited to secure

same, may from time to time and without notice to such customer, be commingled with securities of other

customers and used by us for pledge or re- pledge, hypothecation or re- hypothecation, loans or delivery on

contracts for other customers without our having in possession and control for delivery a like amount of similar

securities. When you pledge securities to your margin account, some or all of the securities acting as collateral

in that account may be used, lent or pledged by us in accordance with SEC rules. When this happens, certain

rights of your ownership related to such securities may be transferred to us or transferred by us to others. In

certain circumstances, such pledges may limit, in whole or in part, your ability to exercise voting rights with

respect to such securities.

Page 6 of 6