Thanks for your response, although I’m not sure I’m following. The allocation must be specified for all categories and subcategories. I can’t leave it blank, or else I get an error.

Furthermore, it’s working as intended for both the equity and the fixed income categories. It’s only the cash category that’s failing.

In the case of equity, there’s two subcategories with a 90/10 split, but I don’t think that’s relevant to my problem since that part works just fine.

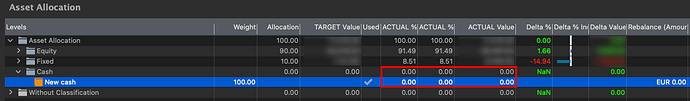

My problem is that the “new cash” deposit account shows up as having 0 EUR in this screen, even though its balance is non-zero. As a result, it’s not counted towards the rebalancing calculation.

I hope this screenshot makes the problem clearer:

If I try giving the cash account any other target allocation different from 0%, such as 10%, PP suggests that I move 10% of my index funds to the deposit account… again assuming that the deposit account is empty, even though it’s not.

Any idea of why PP thinks the deposit account is empty only in this screen?

Edit: Searching through the German forum, I found a screenshot where the rebalancing tool is working exactly the way I want:

https://forum.portfolio-performance.info/uploads/default/original/2X/4/4dc3433e4e65df95018310efe7b975f0dc0b72ec.png

The post is over a year old though (March '23).

Could this perhaps be a recent bug in the current version of Portfolio Performance?