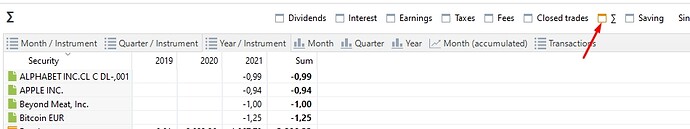

Performance Calculation report shows fees & taxes with positive sign and fee refund/tax refund with negative. But fees/taxes are expenses and should be with negative sign

Hey Vladislav,

positive and negative is a matter of perception, hence a matter of what you are looking at. A financial booking always consists of two transactions and always involves two accounts: Money always goes from one accout to another, negatively into one, positively into the other. The sum always needs to be zero. E. g. taxes are negative in the bank account but positive in the taxes account.

So if I want to display all the taxes I paid I call the taxes account with all its positive bookings.

The terms already imply that they are expenses. Negative fees would mean more money for you. – In the performance calculation widget on the dashboard, the implied sign for each category is shown (to the left).

Two similar topics in German: Widget “Performance-Berechnung”: Vorzeichen bei Steuern und Gebühren, Steuern und Gebühren als negative Zahlen darstellen

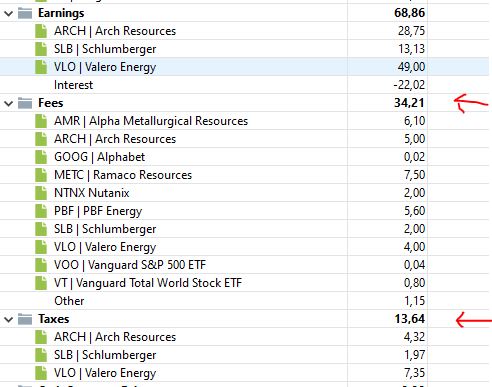

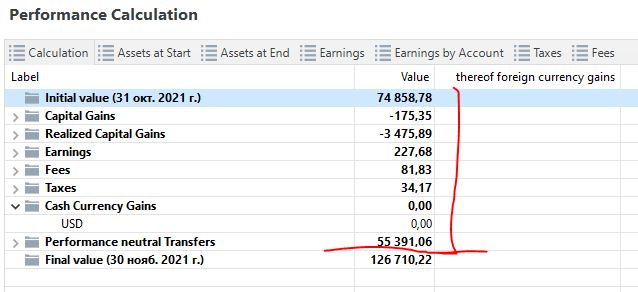

But only one account was included in that report. Only security account. In this case why fees are positive? Any way report has initial value and final value. And it seems that absolute value of fees was took away from initial value to get final value, not added.

Hey Vladislav,

I am afraid I do not understand entirely what you are referring to. Can you explain using some screenshots?

As I said,

Well, that would be correct, I think?

The sum of rows 1-8 is not equal row #9. Why? So repot looks pretty strange

Hey Vladislav,

you are right. I do not think that you have to sum the rowas all up. All line items which negatively influence your performance even though being displayed positively, e.g. fees and taxes are being subtracted.

As @chirlu outlined you have to see the sign of the value together with its name. A fee is positive if you pay it and it needs to be subtracted in this case.

Mabe a more visual examble is the account “Gains”. A gain needs to be added in this case, and a gain is positive if you received a gain. If you lost something the gain is negative. You reflect the same scenario using an account “Losses”. A loss is positive if you lost money (even though for you personally it is rather negative). A negative loss would be a gain but since losses would be to be subtracted in this scenario a gain would be considered as -(-[amount of loss]).

However, the naming of the accounts is as it is:

Gains vs Losses

Taxes (payed) vs. Taxes (received)

Fees (payed) vs. Fees (received)

Of course one could have chosen the names differently, however, the naming is the way that a positive value indicates the standard occurance in an account:

“Gains” (you want to make money)

“Fees” (you typically pay fees)

“Taxes” (your typically pay taxes)